| THE WORLD AS WE SAW IT IN FEBRUARY 2025 |

| The World of Cryptocurrencies |

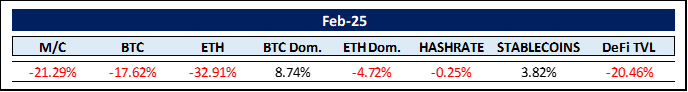

February was quite a shock to the system, as neither we nor anyone in our vast crypto network expected such a drastic storm. So what happened? Despite a host of incredibly positive initiatives for the entire digital asset space taken since mid-January, the market plummeted. In fact, in nominal terms, the crypto market has never lost as much as it did last month. In percentage terms, there were bigger losses, especially during COVID times, but these came from a lower overall market capitalization.

Biggest monthly losses of total market capitalization per Coinmarketcap.com

- Feb-25 -21.29% $ (760 billion)

- Jun-22 -33.99% $ (442 billion)

- May-22 -25.31% $ (441 billion)

- Apr-22 -16.86% $ (353 billion)

- Mar-24 -12.38% $ (331 billion)

We need to dig deeper to obtain an understanding of the forces at play: Bitcoin has fallen by more than -14% (ETH fared even worse at -19%) since trading began on February 21. That’s exactly when the centralized exchange ByBit was hacked. Ethereum assets worth around $1.5 billion were stolen. The exchange reacted quickly and transparently in the minutes that followed. ByBit’s CEO, Ben Zhou, was on a livestream within the hour, providing real-time updates and detailed explanations of what had happened. It was a masterclass in crisis management. In the hours that followed, ByBit proved its solvency and gathered additional support from other major players in the industry in case further problems arose. Nevertheless, a “risk-off” mood was set free. Bitcoin ETFs saw a net monthly outflow of $3.55 billion, while Ethereum ETFs surprisingly bucked the trend and recorded a monthly net inflow of $60 million. The general risk-off sentiment is understandable though. There are assets worth $1.5 billion on the move that want to be sold. That means selling pressure on the market.

Not helping the general sentiment was Donald Trump‘s renewed interest in imposing tariffs on the US’s major trading partners which has wiped 9% off the market value of cryptocurrencies in 24 hours (25 February). “Bitcoin goblin town incoming,” Arthur Hayes, chief investment officer of Maelstrom, said on X, referring to crypto slang for rough times.

But this tainted mood is unlikely to last long. There are too many positive developments in the digital asset space to list them all. Just in the last few days, lengthy proceedings brought by the former US government through the Securities Exchange Commission (SEC) have been dropped. These include proceedings against major companies such as MetaMask, Consensys, Coinbase, Uniswap, Gemini, NFT marketplace OpenSea and others. These actions indicate that the SEC is preparing to move forward and that lawmakers are establishing positive and clear regulations for the digital asset industry.

Adding the Fed to the picture, here is André Dragosch, European Head of Research at Bitwise: “Since the US Federal Reserve cut interest rates in September 2024, financial conditions have tightened with higher yields and a stronger US dollar. Add to this the decline in the global money supply and this combination doesn’t usually bode well for Bitcoin.” Nevertheless, this does not mean the start of a bear market, as many claim. Bitcoin supply on exchanges is drying up, there is demand from institutions and corporations — financial giant Citadel Securities announced plans to become a crypto market maker — which should boost inflows into ETFs, Dragosch said. “The recent setback is more of a temporary correction in the bull market than the start of a bear market”.

Richard Teng, CEO of Binance, views the weakness in cryptocurrencies as more of a tactical pullback than a structural trend reversal. In a Feb. 25 post on X, Teng pointed to historical data suggesting that crypto markets react to macroeconomic changes like traditional financial assets, but prove to be very resilient over time. He drew attention to the downturn in 2022, when Bitcoin temporarily fell below $20,000 in the face of Federal Reserve rate hikes, before recovering as market conditions stabilized. Teng attributed the recent plunge to macroeconomic factors, most notably the Fed’s cautious stance on rate cuts: “It’s important to note that the Fed’s pause is temporary. The recent dip stems largely from the Fed’s cautious approach to rate cuts. While a March cut looks less likely now, it’s crucial to remember that monetary policy is data driven.”

Then there was BlackRock as the first major asset manager to recommend that its clients invest 1-2% of their traditional portfolio in Bitcoin. In doing so, BlackRock draws parallels between the risks of cryptocurrencies and those of mega-cap tech stocks but warns against a higher exposure. In the recently published report “Sizing Bitcoin in Portfolios“, the authors note a remarkable change in Bitcoin’s market behavior since mid-2023. While Bitcoin used to correlate with technology stocks, factors such as geopolitical tensions, the fragmentation of the financial system and waning confidence in traditional banking have led to Bitcoin no longer correlating with these stocks making it an ideal diversification tool. Well, perhaps BlackRock is playing to its own fiddle as the last weeks proved that Bitcoin and other cryptocurrencies still are nerve-wracking volatile.

According to asset manager VanEck, recently proposed bills to create strategic bitcoin reserves in US states could increase demand for BTC by up to $23 billion if passed. VanEck analyzed 20 bills to create bitcoin reserves at the state level and found that state governments would collectively need to purchase about 247,000 BTC. Matthew Sigel, the head of digital assets at VanEck, clarified that the analysis does not include potential BTC purchases by state pension funds. He explained that this is a conservative estimate. Then again, recent volatility in the crypto markets has led 5 states to postpone their decision.

Institutional investors held 25.4% of the assets under management (AUM) of spot bitcoin exchange-traded funds (ETFs) as of December 31 — totaling $26.8 billion. Vetle Lunde, head of research at K33, said that the share of Bitcoin ETFs held by institutions increased by 113% between the third and fourth quarters of 2024. At the end of the fourth quarter of last year, institutions reported $16 billion in Blackrock’s IBIT holdings, compared to less than $4 billion at the end of the first quarter. IBIT captures 50% of the entire BTC ETF market with $48.2 billion in AUM, while the combined AUM of all other bitcoin spot ETFs traded in the US is $47.2 billion.

Here are some prominent institutions and their respective recent moves into the crypto market. Goldman Sachs has doubled its exposure to Bitcoin ETFs, increasing its holdings to $1.5 billion in the fourth quarter of 2024. Mubadala Investment Company, the sovereign wealth fund of Abu Dhabi, has invested in Bitcoin by buying $436.9 million worth of shares in IBIT in the last quarter of 2024. The State of Wisconsin Investment Board (SWIB) increased its BTC investments via IBIT by $110 million to over $321 million in the same period. Further, major financial institutions in Canada and the UK are increasing their exposure to BTC by investing over $280 million in spot Bitcoin ETFs. In particular, the Bank of Montreal (BMO), one of Canada’s largest banks, has allocated $150 million to spot Bitcoin ETFs. On the other side of the pond, in the UK, Barclays Bank has just announced that it has invested $131 million in BlackRock’s IBIT. And this is just the tip of an iceberg. Roughly 75% of crypto ETF holders are still individual, non-professional retail investors. This ratio is going to shift radically towards institutional holders reducing thus inherent volatility.

Moving on to the second biggest crypto by market cap – Ethereum (ETH). ETH is down 34% in 2025 alone. However, according to a recent report by Bitwise, ETH is still the “Microsoft of blockchains“. “Ethereum has the most active developers, the most active users and a market capitalization 5 times larger than its closest competitor,” writes Matt Hougan, Chief Investment Officer at Bitwise. Hougan also pointed out that the majority of stablecoins are issued on the Ethereum blockchain and more than 60% of all DeFi assets are locked on the network.

The Make It Fund is holding on to its ETH holdings, despite or precisely because of its weak performance against Bitcoin. ETH will shine again sooner rather than later, especially in light of recent developments such as the advent of Etherealize. Etherealize is a new institutional marketing and product arm for Ethereum that was founded in New York in January 2025 with the aim of bridging the gap between Ethereum and TradFi (traditional finance). The initiative was founded by Vivek Raman, a former Wall Street professional with experience at firms such as Nomura and UBS. Vivek is joined by former Chromatic Capital managing director Grant Hummer and the fifth richest crypto investor and founder of the Amaranth Foundation, James Fickel, as well as six other Wall Street groomed partners. Etherealize is backed by key figures in the Ethereum community, including co-founder Vitalik Buterin, and is partially funded by the Ethereum Foundation. The main goal of Etherealize is to accelerate the adoption of Ethereum among institutional players such as banks, financial institutions and large corporations, especially with regard to the promising market of RWAs (tokenized real-world assets). Just to put that in perspective, a new report from Security Token Market predicts $30 trillion (with a T) to be transacted in tokenized assets, led by stocks, real estate, bonds and gold by 2030. Etherealize appears to be a response to recent price action, adoption rates and competitive pressures while aiming to reposition Ethereum as the undisputed leader in institutional blockchain adoption, especially now that Wall Street’s interest in cryptocurrencies is growing under a more crypto-friendly US government. Viewing the net inflows into ETH ETFs this month vis-à-vis the huge outflows from BTC ETFs, one might surmise that Etherealize in already having an impact.

On a different note, according to the DeFi report, venture capital funding for blockchain-based start-ups has reached $13.6 billion in 2024. This amount corresponds to 4.9% of the total $279 billion in venture capital investments for the year. The figures reflect a recovery from 2023, when crypto companies received $10.1 billion in VC funding. However, the industry is still far from its peak in 2021, when crypto startups secured $32.4 billion. Highlights of 2024 included Monad Labs raising $225 million to build a layer 1 smart contract network after Berachain received $100 million for its modular blockchain development platform. In addition, Bitcoin staking protocol Babylon raised $70 million, while RWA platform Securitize received $47 million from BlackRock.

Back to the apparently biggest heist in history: Bybit’s hack is reminding us all to keep most of our digital assets stored safely away from exchanges, either by ourselves in cold wallets or through Make-It (our cold wallets are hidden in security vaults underneath the Swiss Alps). Better safe than sorry. But what exactly happened? Without getting too technical, blockchain analytics firms, including Arkham Intelligence and Elliptic, tracked down the stolen cryptocurrencies, which were moved to various accounts. According to Elliptic, the hack far surpasses previous thefts in the sector. These include the $611 million stolen from Poly Network in 2021 and the $570 million drained from Binance in 2022. Elliptic analysts linked the attack to North Korea’s Lazarus Group, a state-sponsored hacking collective notorious for siphoning billions of dollars from the cryptocurrency industry. The Lazarus Group history of targeting crypto platforms dates to 2017, when the group infiltrated four South Korean exchanges and stole $200 million worth of bitcoin. Tom Robinson from Elliptic explained his strategy for the future: “The more difficult we make it to benefit from crimes such as this, the less frequently they will take place”. Certainly, AI will be very helpful in the future to track down stolen funds much faster, i.e. before they can be converted and offloaded.

If you choose to keep your crypto yourself in a cold wallet, make sure to always have access to your private keys. James Howells lost the alphanumeric keys to 8,000 Bitcoin in a British landfill 11 years ago. Since then, the computer technician has tried everything to dig up the hard drive and recover a fortune that is now worth $680 million. He sued the city council of Newport, Wales, to get permission to sift through more than 350,000 tons of garbage – to no avail: — in January 2025, a British court rejected his petition. Now Howells may have only one way out: he wants to buy the entire landfill site where his fortune is buried. Good luck, James.

| The World of Commodities |

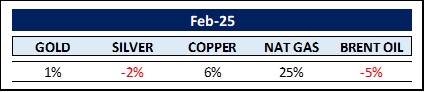

The clear outlier in February 2025 was natural gas (+25%). The sharp rise was likely due to a perfect storm of cold weather boosting demand, depleted inventories, record LNG exports and production constraints, exacerbated by global market shortages.

Gold has been on a tear in 2025 (+40% year-over-year), so let’s take a deeper dive: The most important gold futures market operates in the US, where huge amounts of contracts are traded every day. In contrast, the physical market is operated in London, which is widely considered the center of the global physical gold market since the 17th century. In recent years, around 100 million ounces have been traded daily on the spot markets for immediate delivery, which corresponds to a value of around $300 billion. Bear in mind that about 83 million ounces are produced annually, or 227,000 ounces daily, highlighting the dominance of “paper gold” trading over physical supply. The Bank of England (BoE), the UK’s central bank, holds its own gold reserves in vaults under the City of London. But the BoE also holds the gold of other countries, including many European countries such as Germany, but also India, South Africa and Russia. This role as custodian dates back to the former British colonial empire, but also to the Second World War, when countries brought their gold reserves to London to keep them off the continent.

But cracks have appeared in London’s smooth operations in recent weeks. Normally, buyers can collect their gold a few days after their purchase on the spot market. This wait has now increased to 8 weeks. Financing rates for borrowing gold, normally measured in basis points, have increased more than tenfold. It is well known that central banks around the world have been buying large quantities of gold over the last two years. But the surge in gold demand from London vaults since December 2024 and the escalation since early February has taken seasoned traders by surprise. Something is going on.

The global financial system is changing, and gold is playing a much bigger role in it. It seems that all major central banks are pulling in their global gold reserves. The German Bundesbank had its reserves distributed among the New York Fed, the BoE and the Banque de France for two strategic reasons: Firstly, to park the gold close to the markets with the greatest liquidity for physical trading and, secondly, to diversify for security reasons. But Germany has withdrawn the bulk of deposits from New York and France in recent years. Germany was a frontrunner, but many others followed: the Netherlands, France, Austria, India, Poland and other European countries shifted deposits to their home countries. An Invesco 2023 survey found that in just three years, from 2020 to 2023, the proportion of central banks holding the majority of their portfolios domestically rose from 50% to 68%. The security paradigm is changing: until a few years ago, gold was moved abroad for risk management purposes. Today, gold is repatriated for risk management purposes. That is quite telling.

Beyond above central banks’ repatriation measures, 400 metric tons of gold have recently been ordered to ship from London, via recasting in Switzerland to the US, particularly to the New York Commodity Exchange (COMEX), due to concerns about potential tariffs on gold imports as a result of recent US policy announcements. In addition, traders are capitalizing on the current price differential between the US and the UK on the gold price in USD. Further, investor demand for physical delivery of gold has increased instead of settling futures contracts with cash. The COMEX, as a key trading venue, needs more physical gold to meet this demand, leading to a shift out of the London vaults where there is the aforementioned shortage due to these movements.

Moving on to the black gold – oil: The Department of Energy (DOE) expects Brent Crude to trade at an average price of $74 in 2025. The DOE expects only modest growth in global oil demand combined with rising non-OPEC+ production (particularly in the US, Canada and Guyana). This means that the market will be well supplied in 2025. Global oil demand averaged 102.8 million barrels per day (mbd) at the end of 2024. The DOE assumes that global oil production will increase by 1.6 mbd (around 1.5%) in 2025, while consumption will increase by 1.3 mbd keeping a lid on prices.

Gas prices around the world are influenced by many factors, especially taxes and whether a country has its own resources or has to import them. The average world market price for a US gallon (3.785 liters) is $4.70. As a major supplier, the USA keeps the retail price comparatively low at $3.40. The cheapest gallon in the world can be found in Iran for $0.11, while in Hong Kong the same gallon will set you back $12.90.

The top three commodities in February 2025 were HRC Steel (+24%) – in case you were wondering what HRC stands for, here it is: Hot-Rolled Coil steel. In this process, the steel is heated above its recrystallization temperature (usually above 1,700°F or 925°C) and then rolled into thin, flat sheets or coils. This process makes the steel easier to shape and form compared to cold-rolled steel, although it can have a rougher surface finish. Second place again goes to Eggs (+14%), followed by Lumber (+10%). The bottom three start with Orange Juice (-37%), followed by Potatoes (-35%) and Cocoa (-25%).

The Rest …

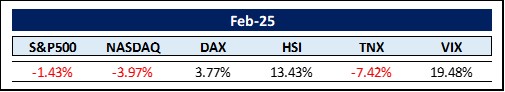

While the S&P 500 has risen by 1.23% since the beginning of the year, and the NASDAQ lost 2.40% during the same period, the Euro Stoxx 600 has risen by almost 7.5%. The difference to the German Dax is even more extreme as it has already risen by more than 13%, This is the biggest difference to the S&P 500 for ten years. The reason for this development is international investors, especially from the US are shifting their investment focus. This is confirmed by the latest fund manager survey published by Bank of America. Within two months, fund managers have increased the weighting of European equities by 36%. In the same period, they have reduced the weighting of US equities by 19%.

This is a bit counterintuitive, as one would assume that Europe would falter under the US tariff threat. It seems that there are several key dynamics at play. Firstly, the fact that Europe is not being hit with tariffs instantaneously has created a temporary reprieve. The delay in imposing immediate tariffs on Mexico and Canada has reduced the immediate pressure on European markets and allowed stocks to rally as investors perceive the tariff threat as a negotiating tactic rather than an imminent reality. Secondly, the prospect of a ceasefire in the Russia-Ukraine war has raised hopes of lower energy prices, reduced geopolitical risks and improved economic stability in the region. This is particularly significant for energy-intensive European economies such as Germany. Thirdly, European companies reported an increase in sales of around 4.7% in the fourth quarter of 2024, the highest since the end of 2022, providing a solid foundation for the rally. However, this trend may not continue. Some analysts believe that the gains in Europe are fragile and based on a lower base and temporary relief rather than structural strength. Earnings growth in the US remains stronger (14.1% in 2024 vs. 7.9% in Europe) and an escalation of tariffs could quickly reverse European momentum, especially in export-heavy sectors such as the automotive industry. For now, however, the combination of delayed tariffs, geopolitical hope, solid earnings and cheaper valuations favors European equities in early 2025.

Consider that the S&P 500 has risen by 648% in the last 15 years. That’s about 4.5 times better than other developed markets and about 8 times the return of emerging markets. This rally has led to an unprecedented imbalance, with US markets accounting for approx. 60% of the MSCI World Index, dwarfing other markets such as China (15%), Japan (6%), the UK (4%), Canada and Germany (3%). This dominance of the US has increased significantly in recent years with the rise of the Magnificent 7 and is particularly remarkable when compared with the US’ share of global GDP, which is around 25%, illustrating the outsized role of the US financial markets in relation to its economic output.

The White House Fact Sheet on the imposition of tariffs makes clear how much less the US economy depends on global trade than other countries: “While trade accounts for 67% of Canada’s GDP, 73% of Mexico’s GDP, and 37% of China’s GDP, it accounts for only 24% of GDP in the US. Yet the US trade deficit in goods in 2023 was the largest in the world at over $1 trillion.” Are the threats of tariffs and thus a global trade war due to countervailing measures real or just a political carrot-and-stick bargaining initiative to push through other goals (take back illegal immigrants, control the flow of drugs into the US, border safety, etc.)? Given the massive trade deficit and tight government coffers, one might be inclined to think tariffs will become a reality in the long run. Should you wish to delve deeper, you’ll find a secure link to the original White House Fact Sheet at the end of this Edition #46.

Dr. Torsten Sløk, Chief Economist at Apollo Global Management, put together an overlay chart of current inflation rates with those of the 1970s. The similarities are too obvious to be ignored. According to this chart, we will see inflation of 15% in 2.5 years, i.e. at the end of 2027. David Rosenberg of Rosenberg Research, however, believes that this decade is not comparable to the 1970s, as there are not as many persistent price threats today as there were then. In his opinion, it is most likely that inflation will decline significantly from now on due to demographic trends, the pace of technological innovation and the growth-inhibiting effects of high debt levels. If all these factors are true, why is inflation so stubborn? There is no question that inflation was low during the years of quantitative easing, even when asset prices were high. This is because money creation was concentrated inside the financial system. When the fiscal spigot was opened during the pandemic, inflation skyrocketed. Since government spending has not been curtailed since then, we still have an inflation problem…

In a noteworthy development, Donald Trump has signed another executive order announcing the creation of a sovereign wealth fund (SWF). SWFs are investment funds managed by nation states – usually countries that generate substantial budget surpluses, such as Norway, Abu Dhabi, Kuwait or Saudi Arabia (all of which generate large revenues from the sale of oil and gas), but also well-managed countries such as Singapore. They have built up funds worth hundreds of billions of dollars or even more than a trillion (Norway, Abu Dhabi, Kuwait) over time. But the US is not exactly known for running budget surpluses. Nonetheless, Treasury Secretary Scott Bessent said at a recent meeting, “We’re going to monetize the asset side of the U.S. balance sheet for the American people.” He also said that the US SWF will be established within 12 months leaving bystanders scratching their heads, where the money is supposed to be coming from?

This could be one of the most incredible stories in modern finance, a story that was completely crazy and unthinkable just a few years ago. Kudos to John at The Econolog for catching this early. It all seems to start once again with the Federal Reserve. In 1934, US President Franklin Roosevelt signed the Gold Reserve Act, which transferred ownership of the gold in the Fed’s vaults from the Fed to the US Treasury. In return, the Fed received “gold certificates” from the Treasury at a price of $35 per ounce of gold.

There is a little known but important difference between the Fed and other global central banks such as the Bundesbank or the BoE. In the US, the Treasury Department owns the country’s gold, not the central bank. The Treasury is sitting on around 280 million ounces of gold, about half of which is stored at the New York branch of the Federal Reserve and the other half at Fort Knox (if it is there), with a total book value of just under $10 billion. And here’s the kicker: the Treasury could repeat its 1934 exercise and issue new gold certificates to the Federal Reserve, but more closely aligned with today’s spot price of nearly $3,000. In return, the Fed would deposit up to $800 billion into the Treasury General Account (TGA) at the Federal Reserve to fund the new sovereign wealth fund without even selling any of the gold. The US gold reserves are no longer a “barbarous relic”, to quote Keynes, but center stage. It will be fascinating to see how this plays out.

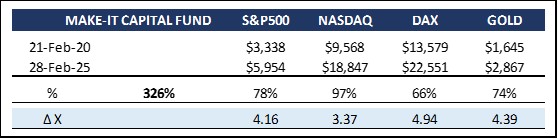

MAKE-IT CAPITAL FUND (the Fund)

| * As a unique hedge fund for a comprehensive blockchain / cryptocurrency portfolio, the Fund allows investors to participate in the full spectrum of distributed ledger / crypto assets with just one investment. * The Fund aims to reduce inherent risk and volatility without compromising performance by applying its proprietary 5-pillar strategy. * The Fund is operated by Make-It Singapore and managed by Make-It New Zealand. * The Fund is fully transparent and always trades at the exact NAV. |

The Fund had its third worst month since its launch in February 2020. This is a wake-up call reminding us of the inherent volatility of crypto markets. With hindsight, it’s easy to conclude that we should have held our shorts longer than we had. Well, the crystal ball doesn’t always work and we actually expected the market to rally by now. Here is Henry Ford: “The only real mistake is the one from which we learn nothing.” Or how about John C. Maxwell: “A man must be big enough to admit his mistakes, smart enough to profit from them, and strong enough to correct them.” We operate in this market for the long term and will always be confronted with a certain degree of volatility. To counteract this, we have established our pillar #2 – long and short trading. As already mentioned, we unfortunately closed our short position too early this time.

The following definition of Bitcoin demonstrates why we are in this for the long term. Bitcoin is the economic representation of the world’s most valuable blockchain network. Every new Bitcoin that is mined is created through investment. These investments flow into data centers, semiconductors, servers and, of course, electricity, which is needed to solve the complex mathematical problems that run the Bitcoin blockchain network. Bitcoin as an asset is the economic reward for those who provide this computing power to keep the Bitcoin blockchain running. In our view Bitcoin is money. It’s a store of value. It is anti-fiat. The Chairman of the Federal Reserve, Jerome Powell has a slightly different but nonetheless interesting view: “It’s just like gold, only it’s virtual, it’s digital. People are not using it as a form of payment or as a store of value. It’s highly volatile. It’s not a competitor for the dollar; it’s really a competitor for gold.”

Thank you for your time and attention

Sincerely,

Philipp L.P. von Gottberg

PS: Here is the secure link to the above White House Fact Sheet: