| THE WORLD AS WE SAW IT IN NOVEMBER 2024 |

| The World of Cryptocurrencies |

Bitcoin (BTC) and Ethereum (ETH) rallied as Trump’s election victory fueled the largest monthly gains since February. We might have seen the start of ‘alt-season‘ which has occurred every time Bitcoin’s dominance got weaker. During alt-season Bitcoin loses some of its dominance while other Level-1, Level-2, or DeFi, GameFi, RWAs, etc. projects gain. Especially Decentralized Finance (DeFi) projects seem to experience a major comeback while stablecoins continue their rise, too.

On November 15, the daily on-chain volume of ETH rose to $7.13 billion, marking the highest daily volume of the year and highlighting the resurgence of Ethereum network activity. Ethereum ETFs, meanwhile, are riding a wave of post-election buoyancy, reversing the billions of dollars of outflows that dampened investor enthusiasm when they were launched in the summer. When the first spot Ethereum ETFs hit the market in July, things didn’t look too rosy at first. The Grayscale Ethereum Trust (ETHE) saw outflows of $1.7 billion in the first five days of trading as the price of ETH fell. Shortly after, the crypto market slumped due to macroeconomic uncertainties and an unravelling yen carry trade, taking global markets by surprise. “The launch of the spot Ethereum ETFs came at an awkward time,” says Matt Mena of 21Shares. “But now the optimism has come back in full force.”

The euphoria over Donald Trump’s election victory has revived one of hedge funds’ favorite crypto trades. It’s the same one that Millennium Management got into in May when it bought around $2 billion in various Bitcoin ETFs. It’s called the bitcoin basis trade whereby basis refers to the difference between the spot price of the ETF and its corresponding futures contract price. The basis trade becomes possible when rising demand drives the price of bitcoin futures higher than the price of spot BTC ETFs (contango). Large funds like Millennium use lightning-fast algorithms to exploit the price gap and reap returns. The price difference reached as high as 17% on the Chicago Mercantile Exchange (CME) during November.

One question that profit-hungry crypto investors are now asking themselves is when the altcoin season will kick into full gear this cycle. Let’s delve a bit deeper: Altcoin season or alt season means that alternative cryptocurrencies perform significantly better than Bitcoin. This happens regularly every four years and can be extremely profitable if done right. So far, in this Trump bump, the main profiteur was Bitcoin (which has risen markedly since Trump’s election victory, increasing its market dominance from 52% to 59% and now back down to 53%). Altcoin seasons usually occur when Bitcoin reaches new highs or during the consolidation phases following such highs. The logic behind this is that once Bitcoin’s sharp price movements slow down, investors switch to altcoins in search of higher returns, often due to the “rising tide lifts all ships” effect, where capital flows from Bitcoin into altcoins. Recent posts on X suggest that altcoin season is right around the corner and will start towards the end of 2024 lasting until March 2025. This assessment is based on technical indicators such as the Altcoin Market Cap (ALTCAP) breaking out and potentially peaking Bitcoin’s dominance. We will make sure to keep a close eye on this.

In October, Microsoft (MSFT) announced that one of the voting items at its shareholder meeting on December 10 will be whether or not the company should invest in Bitcoin. Microsoft’s board has issued a recommendation against buying Bitcoin, but given the recent success of other Bitcoin-holding companies like Microstrategy (MSTR), whose stock price has outperformed MSFT by about 300% this year, shareholders may disagree. MicroStrategy’s Michael Saylor now said he will have three minutes to explain to Microsoft’s board why it should buy Bitcoin. Saylor said, “I don’t think it’s a bad idea to put it on every company’s agenda. It ought to be put on the agenda of Berkshire Hathaway, and Apple, and Google and Meta because they all have huge hordes of cash, and they’re all burning shareholder value.” He added that Microsoft’s enterprise value is 98.5% dependent on quarterly earnings, while 1.5% of the stock’s value comes from tangible assets. “It would be a lot more stable stock and a much less risky stock if half of the enterprise value of the stock was based upon tangible assets or property like Bitcoin. So I think there’s a great argument to be made. I think shareholders should make it.” This decision will not only be very interesting, but may pave the way for many other corporate treasuries to follow suit.

This is the corporate side, what about countries? The Kingdom of Bhutan and El Salvador have already accumulated 12,456 BTC and 5,865 BTC respectively. Switzerland has openly started a discussion on whether Bitcoin should be part of its future strategic reserve. Brazilian politician Eros Biondini has introduced a bill that would establish a Bitcoin reserve to diversify the country’s financial assets. The bill claims that the establishment of a BTC reserve could increase the country’s economic resilience to currency fluctuations and geopolitical uncertainties. Specifically, Biondini proposes to invest up to 5% of Brazil’s $372 billion reserves in BTC through a gradual acquisition strategy. Over in Russia, Vladimir Putin has signed a law that classifies digital currencies as a form of property in foreign trade transactions under an experimental legal regime, taking an important step in the regulation of cryptocurrencies. South Korea meanwhile has agreed to a two-year moratorium on the introduction of cryptocurrency taxation proposed by the ruling party. To the Middle-East: the Central Bank of the UAE has just approved the first regulated dirham (AED) stablecoin.

And even US President-elect Donald Trump has not ruled out such a groundbreaking step. However, Michael Novogratz, the billionaire head of crypto investment firm Galaxy Digital, believes this to be unlikely. Be that as it may, according to Novogratz should the US government pursue such a Bitcoin reserve strategy, the Bitcoin price would likely rise to at least $500,000, as other countries would most surely follow suit. Here is Robert F. Kennedy Jr.: “Bitcoin is the currency of freedom, a hedge against inflation for middle class Americans, a remedy against the dollar’s downgrade from the world’s reserve currency, and the offramp from a ruinous national debt.” And the newly nominated Securities Exchange Commission chairman, Paul Atkins: “Digital assets and other innovations are crucial to Making America Greater than Ever Before.”

A new era for digital assets is also dawning in China that has outlawed mining, trade and ownership of cryptocurrencies in the past. A court in Shanghai has published an opinion stating that personal ownership of cryptocurrencies does not violate Chinese law, offering explicit legal clarity for crypto owners on the mainland. Sun Jie, a judge at the Shanghai Songjiang People’s Court, wrote in an article published on the official WeChat account of the Shanghai High People’s Court that it is “not illegal for individuals to hold cryptocurrency”, even though Chinese companies are not allowed to engage in cryptocurrency investment or token issuance “at will”. The remarks were part of a case briefing on a recent lawsuit involving disputes between two companies over an initial coin offering, which is considered illegal financing in China. Beijing views cryptocurrencies as a threat to financial stability and commercial activities related to these assets are still banned on the mainland, calling their legal status into question. However, the new ruling regarding private ownership could also allow their use for businesses in due time. China’s central bank digital currency (CBDC), the digital yuan or e-CNY, now appears to be firmly established. The reason for China’s flight from anything crypto in the first place was to establish the e-CNY without interference from any decentralized cryptocurrency. Now that this has been achieved, the tide is turning in China further boosting cryptocurrencies. And confirming this: SOS Limited, a Chinese data mining and technology company, announced on Nov. 27 that its board of directors has approved a $50 million investment in Bitcoin to diversify its assets and capitalize on the cryptocurrency’s growing strategic importance. SOS described Bitcoin as an “key digital asset” that has the potential to play a significant role in global reserve strategies. Following the announcement, shares in SOS Limited shot up by almost 100% on November 27, reflecting investor enthusiasm.

And last but not least, Blackrock’s fast-growing iShares Bitcoin Trust (IBIT) has surged past one of the largest funds in a long-established asset class: gold. According to FactSet, the Bitcoin exchange-traded fund has roughly $53 billion in net assets (Dec. 6). This puts it ahead of the iShares Gold Trust (IAU), which had just over $33 billion.

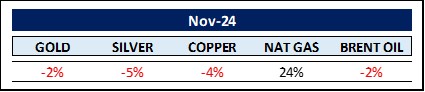

The World of Commodities

While precious metals were able to shine this year with a rise of 28% (gold) and 30% (silver), industrial metals suffered: HRC Steel lost 37%, iron ore 24% and lithium 20%. The main reasons for this are the slowdown in growth in China and the lower than expected sales of electric cars.

In the agricultural sector, cocoa (130%), coffee (76%) and sunflower oil (60%) are the price leaders, while soybeans (-24%), rice (-14%) and wheat (-14%) are the laggards.

But back to precious metals and price forecasts for 2025 and beyond: Gold prices are expected to rise significantly in 2025. Goldman Sachs analysts predict that the price of gold could reach the $3,000 per ounce mark by the end of 2025. This forecast is determined by several factors, including geopolitical tensions, central bank purchases and possible financial sanctions.

However, quite a few analysts are predicting 2025 as the year for silver. InvestingHaven predicts that the silver price could test its all-time high, with a target of $50 or even higher. Some forecasts predict that the price will rise to $77 by 2028 and over $82 by 2030. JP Morgan forecasts an average price of $36 per ounce in 2025, influenced by factors such as monetary policy, industrial demand and potential supply shortages. Analysts at CoinPriceForecast believe that the price could rise to between $33 and $55.87 per ounce by the end of 2025. Prices are likely to be driven mainly by industrial demand. The role of silver in electronics, solar energy and electric vehicles is expected to significantly increase. Global silver demand is forecast to reach 1,155 million ounces in 2025, while silver supply is expected to be around 1,062 million ounces. This indicates an increasing supply deficit that has been a trend since 2021 now.

What about Dr. Copper? Well, it’s experiencing one of the biggest supply/demand imbalances in the entire commodities market. Demand for copper from the green energy sector, including electric vehicles, renewable energy technologies like solar panels and wind turbines, as well as traditional applications in construction and electronics, is growing rapidly. The transition to a more sustainable economy is significantly increasing the demand for copper. On the supply side, mines are aging, ore grades are falling and there is significant water stress in key mining regions. Goldman Sachs has pointed to the potential for large copper deficits by the end of this decade, as copper is particularly in demand due to its crucial role in the energy transition. And that’s not even taking into account geopolitical tensions and capital constraints due to ESG headwinds and ever-rising construction costs. As a consequence, a forecast from 2023 suggests that the copper deficit could increase dramatically. Estimates suggest a potential deficit of up to 9.9 million tons in 2030 if current trends continue and supply dynamics do not change significantly. In summary, the imbalance between supply and demand for copper is remarkably high and is expected to increase. Demand could double by 2035 and exceed the growth in supply if no new sources are developed or recycling does not become more efficient.

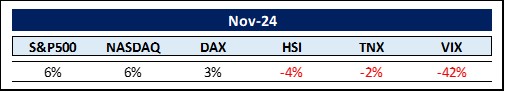

The Rest …

Stock market trends continue to rise because investors believe that a soft landing is imminent and that the next important step will be a reacceleration of global growth. Volatility as measured by the VIX decreased by an amazing 42% demonstrating a risk-on mood among investors since the US election.

Economist Ed Yardeni believes that the current upward momentum will continue expecting the S&P 500 to reach the 10,000-point mark by 2029. His forecast reflects a number of factors that he trusts will boost investor confidence, including tax cuts, deregulation and technological advances. Yardeni particularly highlights the potential for large tax cuts for businesses. He suggests that Trump could lower the corporate tax rate from 21% to as low as 15%, which would significantly increase corporate profitability. Deregulation would further help companies expand their profit margins, while technological advances, driven by AI, will boost overall productivity. With all the current optimism, however, we should never forget Yale economist Irving Fisher, who proclaimed in October 1929 that stock prices had reached a ‘permanent plateau‘. Unfortunately, this statement became infamous when the market crashed shortly thereafter, triggering the Great Depression. Always remain vigilant. After all, as Mark Twain said: “Success is a journey, not a destination. It requires constant effort, vigilance and reevaluation.”

Turning to the most watched corporate numbers in November: Nvidia’s net profit in the third quarter amounted to an incredible $19 billion – as much as the company’s entire turnover in the corresponding 2023 third quarter. The price-to-earnings (P/E) ratio is now more than 50 times and Nvidia alone accounts for about 7.2% of the S&P 500, followed by Apple (6.9%), Microsoft (6.1%) and Amazon (3.7%). A P/E ratio of 50 is rarely justified, especially for very large stocks. These kinds of valuations bring back memories of the Nifty Fifty.

The Nifty Fifty were a group of 50 large-cap stocks that were very popular with investors in the 1960s and early 1970s. These stocks were considered “one-decision stocks,” meaning investors believed they could buy and hold them forever due to their strong growth potential and solid fundamentals. The Nifty Fifty included well-known companies such as IBM, Coca-Cola and McDonald’s. However, in the 694 days between January 11, 1973 and December 6, 1974, the Dow Jones Industrial Average of the New York Stock Exchange experienced the seventh worst bear market in its history, losing more than 45% of its value, with some of the Nifty Fifty stocks losing as much as 90%. Thus, even though demand for Nvidia’s new Blackwell chip is “exceeding all expectations“, don’t get too greedy as the market starts to feel frothy. The Spanish-American philosopher George Santayana comes to mind: “Those who cannot remember the past are condemned to repeat it.”

The dollar has done nothing but rally since the US election. The US government bond market has done nothing but fall since the first 50 basis point rate cut in September. When the dollar rises, that means demand rises. That money has to go somewhere. The most logical place to invest cash is in government bonds. Normally, that would depress yields and drive up government bond prices. Yields at the long end of the curve are surging though. This indicates that dollar demand is not directed towards the 10-year maturity. The dollar’s strength reflects the assumption that Trump’s new tariff regime will hit exporters to the US harder than the US itself. Treasury market weakness signals deep concern about the prospect of more spending and no clear plan on how to deal with runaway deficits. The conflict arises because a strong currency is usually accompanied by strong demand for a country’s financial assets. It is strange to have a strong currency and a weak government bond market…

Staying with tariffs, the market is worried about what the rest of the world will do if the US imposes high tariffs, which seem to be the cornerstone of Trump’s financing plans. Of course, such mercantilist policies also have an impact on other countries. After all, the US is not in a vacuum. If the US imposes tariffs on Chinese exports, China will work harder to find alternative markets. Stronger alliances with Russia, Germany, Japan, Australia, etc. will be sought to counter such trade restrictions. Furthermore, tariffs only work if they can be adequately monitored. It has been common practice for years to put the finishing touches to a product in a third country before it is exported to its final destination. In order to impose tariffs on China, the US would also have to monitor exports from Malaysia, Indonesia, Mexico and many other countries. This may not be practical for cost and geopolitical reasons. Another consequence of Trump’s tariffs is the recent strength of the US dollar as other countries devalue their currencies to ease pressure on their manufacturing sector. This can become a competitive process as each country seeks the same benefits. However, devaluation also carries risks. Investors may flee to regions with strong currencies during the devaluation phase and are unlikely to return until the situation has stabilized. In any case, tensions in the global trading system will intensify. The resurgence of mercantilist policies is being met with mixed reactions. Some see it as necessary for national security and economic sovereignty, while others see it as regressive, potentially leading to inefficiencies, global economic frictions and a deviation from the benefits of comparative advantage and free trade advocated by classical economics. Be that as it may, the implementation of the new mercantilist policies seem as a foregone conclusion – with all its consequences.

In 1980, the US federal debt amounted to about $1 trillion while the GDP was $2.8 trillion. Today, the federal debt is over $36 trillion while GDP is around $29 trillion. So over the last 44 years, GDP has increased by a factor of 10, while the federal debt has increased by a factor of 36. We can assume that even under the new administration, economists will remain enamored with Keynes’ 1936 proposal to boost GDP and employment through deficit spending. However, one thing is certain: the real value of fiat currencies relative to hard assets will continue their fateful slide.

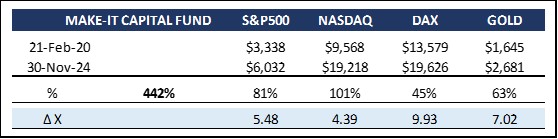

MAKE-IT CAPITAL FUND (the Fund)

| * As a unique hedge fund for a comprehensive blockchain / cryptocurrency portfolio, the Fund allows investors to participate in the full spectrum of distributed ledger / crypto assets with just one investment. * The Fund aims to reduce inherent risk and volatility without compromising performance by applying its proprietary 5-pillar strategy. * The Fund is operated by Make-It Singapore and managed by Make-It New Zealand. * The Fund is fully transparent and always trades at the exact NAV. |

It’s no surprise that the Fund had an amazing month. We’re glad we held on to our rather large position in Ethereum as the price continues to rally, as we predicted in Editions #42 and #43. We also got involved on the short side of the market when BTC bounced from its initial run towards $100k. Finally, we are currently reviewing the markets for further diversification into select altcoins.

In the world of cryptocurrencies, Bitcoin has become what Aristotle might have called a first principle of financial evolution. I am confident that, based on this first principle, we can build a financial system that cares about people and privacy, that encourages innovation and offers equal opportunities to all. And now we seem to get the political will to do so.

The US attitude towards the crypto industry has just done a U-turn. From a “crypto-hostile” SEC (SEC Commissioner Hester Pierce) to the departure of Gary Gensler (who resigned before being fired by Trump). From an antagonistic political environment to 275 pro-crypto candidates versus 122 anti-crypto candidates in the House of Representatives and 20 pro-crypto versus 12 anti-crypto candidates in the Senate. Brian Armstrong (CEO of Coinbase) said it best: “Welcome to the most pro-crypto Congress in American history.” The crypto momentum in the US is back and that has far-reaching implications. The year 2025 will be seen as the most significant year yet for cryptocurrencies. And it is certainly not too late to get on board.

Thank you for your time and attention

Sincerely,

Philipp L.P. von Gottberg