Make-It Capital Edition #37

The World of Cryptocurrencies

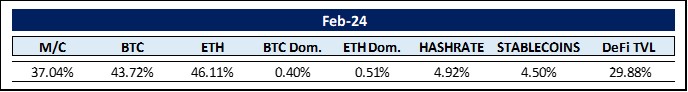

February was one of the best months crypto has ever seen across the board as being documented by above numbers.

The new Bitcoin exchange-traded funds (ETFs) recorded a trading volume of more than $10 billion dollars in their first three days on the trading floor. They outperformed every single one of the more than 5,500 ETFs launched in the last 30 years. After just 21 days, the 10 funds had amassed a total of $2.8 billion dollars in net inflows. Since then, they have accumulated significant amounts of BTC. Currently, these ETFs collectively hold around 300,000 BTC, or approximately 1.5% of all BTC, which is worth around $18 billion. The ongoing marketing campaigns of these ETF issuers will continue to support Bitcoin prices as more and more investors will mix Bitcoin with their traditional investment portfolios. The second Bitcoin catalyst will be the halving in April. Historically, Bitcoin tends to rally +32% into the halving, as measured by the two-month run-up to the halving.

Then there is the hotly anticipated approval of the Ethereum (ETH) ETF. Standard Chartered anticipates that ETH ETFs could be approved on May 23, when the final deadline for the first wave of applications expires. It is worth noting that Bitcoin ETFs were also approved within the last deadline. In support of this argument, Standard Chartered points out that the SEC has not classified ETH as a security in other filings and the Chicago Mercantile Exchange (CME) already lists and regulates ETH futures contracts. Coinbase’s Chief Legal Officer, Paul Grewal, even recently urged the SEC to approve Grayscale’s application to convert the Grayscale Ethereum Trust into a spot ETH ETF much sooner. After all, “in fact, before and after the Merge, the SEC, the CFTC and the market have treated ETH not as a security but a commodity,” so there’s absolutely no reason to delay.

Moving on to an ‘evergreen’ topic: energy consumption of crypto: We recently came across an interesting study comparing industries according to their use of renewable energy. And the results are surprising, to say the least:

Bitcoin mining: 52.6%

Banking sector: 39.2%

Industrial sector: 32.0%

Agricultural sector: 19.6%

Gold industry: 12.8%

Iron and Steel industry: 9.8%

Zinc recycling industry: 1.0%

Who would have thought that Bitcoin mining is the most environmentally responsible industry of all?

Here’s another surprising fact we stumbled across. We currently have $143 billion in stablecoins on-chain, with Tether taking $100 billion and USDC from Circle taking $28.5 billion. What’s really amazing is that in 1980 there were only 120 billion in fiat USD in circulation. So, we already have more USD-backed stablecoins on-chain than we had fiat USD fiat 44 years ago.

As part of our ongoing research into potential crypto investment opportunities, we see many new trends developing in cryptocurrencies and will briefly discuss two of them today:

Firstly, DePIN, which refers to Decentralized Physical Infrastructure Networks and is a novel approach to building and maintaining the world’s physical infrastructure. According to Raullen Chai, CEO of IoTeX, DePIN offers the most realistic implementations for blockchain technology to date and will become one of the most important crypto investments of this decade. As the term suggests, it describes a category of projects that provide certain tokens as an incentive to build all kinds of physical infrastructure, such as decentralized computing clouds, decentralized WiFi, decentralized mobile networks and cloud storage, to name a few.

Anyone can contribute to these decentralized networks, as long as they have the right hardware. And according to the latest Messari report: The State of DePIN 2023, “DePIN can be more resilient, efficient and powerful than a centralized infrastructure.” For this reason, the authors agree that DePIN projects have an inherent flywheel, meaning that these decentralized infrastructure networks “get stronger the bigger they get”. This positive feedback loop is reinforced by a growing number of users and providers of said infrastructure. In this context, the authors note that DePIN projects will add $10 trillion to the economy over the next 10 years. Be that as it may, it is definitely worth keeping a close eye on these developments.

There are already around 650 crypto companies operating in one of the six DePIN categories: Compute, Wireless, Energy, AI, Services and Sensors. Together, they have a current market capitalization of $20 billion. The top DePIN projects have raised $ 1.2 billion from Venture Capital.

The second and probably even more significant area relates to AI+crypto. ABCDE Investment Partner Lao Bai wrote in a recent Medium post that we are seeing a number of emerging AI projects that show a significant improvement in the understanding of the technology. He classifies these projects as each belonging to one of the three main directions of “AI+crypto”. The three paths are the “assetization of computing power”, the “assetization of models” and the “assetization of data”.

- Assetization of computing power includes projects that offer decentralized computing power that can be used for either “AI training” or “AI inference”.

- Assetization of models includes projects that offer tokenized use cases of AI models such as AI agents.

- And finally, the assetization of data is about projects that offer decentralized data collection for AI models. If you are interested, I recommend the original article, to which I have attached a direct link at the end of this Edition #37.

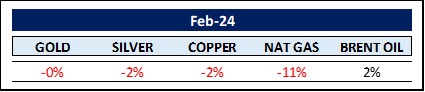

The World of Commodities

US gas futures slumped last year as an unusually mild winter curbed consumption and shale gas drillers boosted production, leaving domestic inventories well above normal levels. It was a sharp reversal for prices, which had risen to a 14-year high in 2022, after Russia invaded Ukraine and drove up European demand for US gas supplies.

“The news from Chesapeake to cut production has created the perception that natural gas prices have gotten too low,” said Dennis Kissler, senior vice president for trading at BOK Financial Securities. “More producers may follow suit, which is necessary to eliminate oversupply.”

Another reason for the slump in natural gas prices appears to be the Biden administration’s decision to delay or ban additional LNG export terminals. While this has not stopped the operation of current export facilities, it has put the brakes on future expansion plans.

Moving to oil: Several members of the Opec+ oil cartel are extending their voluntary production cuts into the second quarter. Saudi Arabia announced recently that it would maintain its production cuts until the end of June. After that, it will be gradually reduced in line with market conditions, the state news agency SPA reported. Russian Deputy Prime Minister Alexander Novak announced an additional cut of 471,000 barrels per day (bpd). Other countries belonging to the cartel also announced a continuation of the cuts. Then there are the geopolitical tensions in the Middle East and the ongoing barrage by the Houthi rebels on ships crossing the Red Sea. In consequence, we could be surprised by significantly higher oil prices.

A clear outlier in the commodity markets currently is Cocoa. Due to an extreme imbalance between supply and demand, cocoa prices are in a huge bull market. In fact, prices have surpassed the previous 46-year ATH.

Back to energy: the solution to mankind’s energy problems could be nuclear fusion (not to be confused with nuclear fission). Industry insiders know that we have reached a turning point with this technology. Materials technology, fusion technology and the use of artificial intelligence are so advanced that nuclear fusion can become a reality. For this reason, investment in this area has skyrocketed. Last year, around 6.2 billion dollars were invested in nuclear fusion, of which 5.9 billion dollars were invested in private companies. And take a look at the investors: Jeff Bezos, Paul Allen, Peter Thiel and even Chevron. Quite revealing.

The Rest …

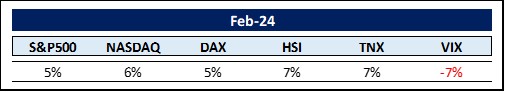

This relentless equity rally has broken several records. The S&P 500 has now risen in 16 of the last 18 weeks. The last time this happened was in 1971, shortly before the end of the Bretton Woods system.

It is equally remarkable that the Japanese Nikkei225 has finally risen to an all-time high after a long wait of more than 34 years. It is not just the Japanese stock markets, but also the Japanese real estate market, which is being fueled by sharply negative real interest rates and imported inflation. Prices in major cities such as Tokyo have now reached the level of the 1989 bubble, when the Imperial Palace was worth more than the entire state of California.

The most predicted recession of all time was the headline in May 2023. In December, it became “a soft landing is inevitable”. Today, several central bankers are talking about the need to ease policy when signs of a slowdown emerge. If history is any guide, recessions only come when everyone has forgotten their earlier concerns.

Anyhow, in case you haven’t noticed, we live in kind of a clown’s world today. By this I mean that weak economic data, such as job losses, is positive for the markets as it means the Fed is more likely to cut interest rates. This will lead to more borrowing, which will ultimately lead to higher markets.

And all is based on fiat money. Fiat money differs from commodity money, which has an intrinsic value in addition to its exchange value, such as gold, silver, rice, or salt. The term “fiat” is derived from the Latin verb “fieri”, which means “to come into being”. Fiat can be translated as “it comes into being” or “it becomes”.

So, the value of the number one fiat currency, the US dollar, is based on nothing other than our trust in the government. I have to say that I prefer to trust the mathematics on which BTC is based.

Besides, there may be some dark clouds on the horizon for our world reserve currency. On February 1, Bloomberg reported that Saudi Arabia had accepted its invitation to join the BRICS group of developing nations (Brazil, Russia, India, China, and South Africa). That was according to South Africa’s foreign minister. The next day, however, an official Saudi source said the invitation was still under consideration. Let’s see how this plays out.

Anyhow, since 1973, Saudi Arabia has been selling oil to the US, which is invoiced in US dollars. This petrodollar system is an important reason for the global dominance of the US dollar. However, if Saudi Arabia joins the BRICS, this could jeopardize the global dominance of the dollar. This shift could be the catalyst that accelerates a massive, long-term decline of the US dollar. Simply put, Saudi Arabia joining the BRICS could trigger the biggest currency story in the last 50 years. So let us definitely watch this closely.

Different topic: According to a recent report by Hong Kong-based financial services group GaveKal, the technology and communications services segment in the US now accounts for around 40% of the total US equity market.

Can two sectors really account for 40% of US earnings over the long term? Moreover, the US now accounts for 70% of the global equity market value (up from 45% at the end of 2007 and 35% in 1994)!

“This level of market concentration has developed even though the US accounts for only about 4.3% of the world’s population and 17.8% of global GDP”.

For those not actively involved in a mania, nothing makes sense. For those who have been around for a long time and hold several years of accumulated profits, the logic is clear. The price-to-sales ratio at which Nvidia is trading is impossible to meet. However, investors have seen exceptional valuations in the past (Tesla, Netflix, Meta Platforms), so they are willing to believe it is possible again. The first company to reach a $1 trillion valuation seemed like an impossibility, but a few more have come along. The way to invest in a great bull market is to believe in the impossible. That works until everyone who has the capacity to buy has done so.

According to Apollo Asset Management forward P/E ratios for the top 10 tech stocks right now is 40x. Compared to 2000, at the peak of the Dot-com bubble, the forward P/E on the top 10 tech stocks was 26x.”

Turning to China where we see several important developments:

The Chinese economy is slowing down. The Chinese real estate market is in trouble (as we saw when indebted developer China Evergrande was ordered to liquidate last month). And above all, the fear of regulation is still fresh in the minds of investors. However, the regulatory crackdown is already years old and it’s unlikely that Beijing will come up with a new wave of anti-business surprises. And when everyone already knows all the bad news, any news that isn’t the end of the world feels good.

Usually, it doesn’t take much to trigger a rally when a market is so hated. Copley Fund Research published a report recently with the details. They analyzed 340 global equity funds with more than $1 trillion in total assets to see what they own. The change in fund managers’ exposure to China is remarkable. The average fund now has just 2.1% exposure to Chinese equities. This is the lowest level since records began in 2012, down from a high of more than 5% in 2021.

The leadership in Beijing is taking note and concrete steps to allay investor concerns. One of the biggest steps was taken on February 7th when China replaced the head of the China Securities Regulatory Commission (CSRC). This organization is the Chinese version of the US Securities and Exchange Commission (SEC). The last CSRC chairman took office in 2019, shortly before the regulatory crackdown began. It’s significant that the former chairman was removed during a market slump. Most see the change as an admission by Beijing that it has been too aggressive and is moving to a less antagonistic stance.

China also has banned large institutional investors from reducing their equity holdings at the beginning and end of each trading day. This is part of the government’s most forceful attempt yet to shore up the country’s $8.6 trillion stock market. The ban on selling at the beginning and end of the trading day is aimed directly at ETF rebalancing, which often takes place in the last half hour of the trading day. It also targets hedging activity that would have to be netted by the end of the day.

Beijing’s third move came July 07, 2023. More than two years after the imposed death of Ant Group’s IPO, the government ended its campaign against the company by fining it 7.1 billion yuan (roughly $1 billion). Industry experts see this as a sign that Beijing is ending its crackdown on the technology industry.

The Chinese markets may well be at a crucial turning point. It can’t get much worse from here — and that means it probably won’t.

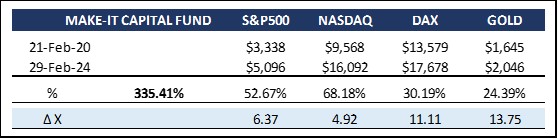

MAKE-IT CAPITAL FUND (the Fund)

- As a unique hedge fund for a comprehensive blockchain / cryptocurrency portfolio, the Fund allows investors to participate in the full spectrum of distributed ledger / crypto assets with just one investment.

- The Fund aims to reduce inherent risk and volatility without compromising performance by applying its proprietary 5-pillar strategy.

- The Fund is operated by Make-It Singapore and managed by Make-It New Zealand.

- The Fund is fully transparent and always trades at the exact NAV.

The Fund had another remarkable month. Apart from riding the wave of this new bull market, we are particularly proud of our improved Pillar #3: Market Making & Arbitrage, which is currently yielding a safe return of up to 70%. Truly exceptional.

The most interesting thing about the success of BTC ETFs is that they are gaining market share at the same time as funds are being withdrawn from gold ETFs. Here are the numbers to back up this statement: Gold ETFs have lost $2.4 billion since the beginning of 2024. BTC ETFs have gained $3.9 billion in the same period. You could really start to call Bitcoin digital gold.

And crypto is becoming mainstream in Europe, too. Deutsche Boerse AG, the leading Germany-based equities and securities trading company, has launched a crypto spot trading platform called Deutsche Boerse Digital Exchange (DBDX) for institutional clients. The new platform will allow corporate clients to buy and sell cryptocurrencies in a compliant manner while holding their digital assets in custody. The head of foreign exchange and digital assets, Carl Koelzer, also stated that Deutsche Boerse’s goal is to provide trusted market services for cryptocurrencies that ensure transparency, security, and regulatory compliance for institutional clients in Europe.

All the pieces are falling into place and preparing us for a long-lasting bull market. Mind you, this is crypto. There will be ups and downs, except that the ups will have the upper hand over the next 1–2 years.

Henry Ford comes to mind: “Coming together is a beginning, staying together is progress, working together is success”.

There has been so much doubt, ridicule and even hatred towards our crypto markets. Well, I suppose most of that has evaporated or even done a 180-degree turn by now.

Let me leave you today with Audrey Hepburn: “Nothing is impossible, the word itself says I’m possible”.

Thank you for your time and attention.

Sincerely,

Philipp L.P. von Gottberg

Here is the promised link to the AI+Crypto article mentioned above: