Make-it Capital Edition #34

The World of Cryptocurrencies

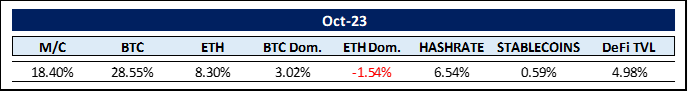

October was one of the best months we have seen in the crypto world for a long time. The overall market increased by $206 billion, reaching $1,325 billion, its highest value since April 2022. Most notable was the rise of bitcoin, which increased by 28.55% while gaining 3% to reach a market dominance of 51%, a significant increase from the beginning of the year when it stood at 42%. The crypto market has clearly decoupled from the stock market, which was in negative territory this month.

The Hashrate reached a new high ever solidifying the entire network. In the world of stablecoins, Tether (USDT) climbed to a new ATH (all-time-high) in terms of market cap reaching $84.5 billion or about 70% of the entire stablecoin market. DeFi TVL (decentralized finance total value locked) is also recuperating nicely.

This month’s cover image was chosen to draw attention to a potentially groundbreaking development in bitcoin mining.

According to a report by Bloomberg analyst Jamie Coutts, clean energy now accounts for over 50% of bitcoin mining. This change is primarily due to the exodus of miners following the mining ban in China and the active search for renewable energy sources such as hydropower, solar power, wind power and even gas flares, to name a few. Moreover, new countries like El Salvador, Bhutan, Oman, and the United Arab Emirates are using their respective green energy sources to enter the bitcoin mining race.

In addition, Texas Senator Ted Cruz recently spoke about the positive impact of bitcoin mining on the Texas power grid, saying, “It’s essentially an emergency reservoir of power. I think that’s one of the tools we can utilize to enhance resiliency in the grid”, as bitcoin miners are able to monetize the excess capacity that would be wasted on an average day, but that capacity can be throttled in seconds, injecting energy back into the grid as needed.

Further, in 2021, Tesla CEO Elon Musk announced that the electric car giant would accept bitcoin as payment once miners use more than 50% clean energy with a “positive future trend“. This milestone appears to have been reached recently, but Musk has yet to confirm any updates to Tesla’s bitcoin payment policy. If Musk acknowledges bitcoin’s newfound ESG-friendly nature, it will open the spigot for ESG-focused institutions und funds increasing demand for bitcoin markedly.

A recently published paper co-authored by Ethereum founder Vitalik Buterin has attracted a lot of attention (the link to the original paper can be found at the end). The paper, which focuses on a novel privacy-enhancing protocol called “privacy pools“, suggests that a practical balance can be achieved for the coexistence of blockchain privacy and regulatory compliance. This solution would be important to bridge the gap created by the US government’s sanctioning of Tornado Cash last year – the largest on-chain privacy tool for crypto transactions on the Ethereum blockchain.

To achieve this, the paper proposes a modification to the existing operational blueprint of crypto mixers in the form of so-called “association sets”. Privacy pool “association sets” are customizable anonymity sets in which whitelisted users can choose which sub-pool of deposits and withdrawals to mix with.

For example, there may be a “Deposits from Sweden” association set, or one “Deposits from Coinbase”, or “Deposits from non OFAC sanctioned addresses”, etc. By including such association sets, according to the paper, it would be possible for users to verify their disassociation from illicit funds by creating a zero-knowledge proof showing that the withdrawals were made from an association set on the whitelist.

In other words, proof to demonstrate their own funds did not fall into the wrong hands. The paper was praised by many crypto industry leaders. Fred Ehrsam, the co-founder of Coinbase and Paradigm, called it the “most important tool we have to address regulatory challenges while maintaining privacy on public blockchains” while for Ryan Selkis, co-founder of Messari, it was simply the “news of the year”.

Privacy pools working through association sets offer a lean first step in the right direction. The proposed solution, however, will require further finetuning before being widely adopted and accepted by regulators.

Switching to NFTs (non-fungible tokens): According to a recent study by dappGambl, 95% of the more than 73,000 NFT collections are now considered worthless. The NFT market, made famous by pixelated monkeys, seems to have peaked in July 2021 when British artist Damien Hirst made headlines.

He offered to anyone who bought from his newest collection – The Currency – would receive a NFT instead of the original piece of art. Then, they had a year to decide which format they wanted to keep. If you chose the NFT, Hirst promised to destroy the original piece. In the end, 4,851 buyers decided to keep the NFTs. And Hirst began a mass burning of his original art. This whole story… creating art, turning it into an NFT, and then burning the original… is about as peak bull market a story as you could get. And it has been downhill ever since.

Although the Fund has never participated in the NFT market, we believe that the NFT market will regain strength as soon as applications with added value for the real world are developed. Think of game avatars that can be passported across Web3 games. Or NFTs for secure medical history storage, insurance policy NFTs that can be traded, charity NFTs that can be displayed in personal records, political campaigns – be creative. The list is endless. I am sure the NFT market will see an amazing boom once Web3 is truly established.

The World of Commodities

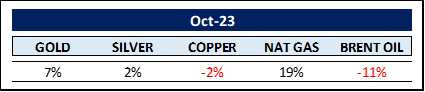

The flight to safety caused the price of gold to rise to almost $2,000, a high for the year. The gold-silver ratio stands at 87.5, also a high for the year. Only two things can happen now. Either gold falls, or silver closes the gap. According to The Silver Institute, the PV industry will consume more than a tenth of the global silver supply in 2023. Cells with new technology consume much more silver: while current PERC consumes 8.6 milligrams per watt, next generation TOPCon consumes 12 milligrams and heterojunction cells even 22 milligrams. In an already fast-growing market for solar modules, I am in favor of silver closing the gap.

The price of natural gas has risen sharply this month, but is still down -21% for the year. Despite efforts by OPEC and Saudi Arabia in particular to curb output, oil prices have fallen sharply this month due to the global economic slowdown. According to an OPEC report, oil markets could face a deficit of 3.3 million barrels per day in the fourth quarter, which would be the most severe shortage in more than a decade. So far this year, oil prices have fallen by -2%.

The new star in the commodities sky is uranium, up 40% this year. According to the International Energy Agency, nuclear energy supplies around 10 % of the world’s electricity. It comes from around 440 reactors in 31 countries with about 390 gigawatts of electrical power (GWe). The uranium price war is over. Between 2011 and 2016, Kazakhstan flooded the market with its supply. As a result, several smaller mining companies were forced out of business. Even Cameco closed down mines and supplied itself with long-term contracts by making spot purchases on the open market. The introduction of the Sprott Uranium ETF helped to soak up the available supply, setting the stage for the current recovery. In addition, there are fears that Russian supplies could be banned due to the war in Ukraine. After all, Russia is a major supplier of both uranium and uranium-enriched services, accounting for almost 40% of the world’s total uranium conversion infrastructure.

One of the most affected commodities is lithium carbonate, which has fallen by -68% over the course of the year and is expected to fall further. Weaker demand for electric vehicles combined with an oversupply of lithium seems to be a toxic mix.

The Rest …

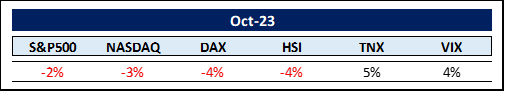

In stark contrast to the crypto market, the stock markets lost value across the board due to the slowdown in global economic growth.

According to Peter Oppenheimer, chief global equity strategist in Goldman Sachs Research, just 15 companies accounted for more than 90% of the returns of the S&P 500 Index in 2023. That is pretty rare and most likely driven by the promise of AI. The latest monthly survey by Bank of America (BofA) found a decisive shift in sentiment among global fund managers: Betting on the US while completely backing out of China. The latest survey included responses from 258 participants with $678 billion in assets under management. According to the survey, the US economy is poised for a soft landing, US interest rates have peaked, there zero optimism about China, Japan is back on the radar screen, and one should buy technology stocks even though it’s already a crowded bet. In particular, “avoid China” has become one of the biggest beliefs among fund managers surveyed, according to BofA, with 0% expecting stronger economic growth in the near future, a massive turnaround from 78% in February. Furthermore, China’s problems are dragging all emerging markets down with it and they should also be avoided for now.

Perhaps it was too early to write China off.

The latest set of number coming out of China tell the Chinese economy grew faster than expected in the third quarter thanks to rising domestic demand. According to the statistics office, gross domestic product (GDP) rose by 4.9 percent year-on-year from July to September. Growth in retail sales, an indicator of consumption, also exceeded expectations. The world’s second-largest economy is showing initial signs of stabilization thanks to a series of political measures, but the ongoing real estate crisis, uncertainty regarding employment and household incomes, and low private sector confidence pose risks to a sustained recovery. So there are signs of hope, how well-founded they are remains to be seen.

Global debt vs global GDP

Global debt reached a record $307 trillion in the second quarter of 2023, led by Japan and the United States. And according to the World Bank, global GDP has reached $100.56 trillion. Thus, the global debt is three times as high as the global GDP.

The Institute of International Finance (“IIF“) reported that global debt increased by $10 trillion in the first half of 2023 – and by $100 trillion over the past decade. More than 80% of the recent increase in debt was in the developed world, with the US, Japan, the UK and France seeing the largest increases. There has also been a significant increase in emerging markets, particularly in China, India and Brazil. With interest rates currently expected to remain high, emerging markets could come under pressure as investment shifts to the more stable developed economies.

According to a report by CNS Insider, around 70 emerging and developing countries are already affected or threatened by debt problems – a record number that has put the World Bank on alert. Nigeria, for instance, already spends most of its substantial government revenue on servicing its debt. The insolvency of these emerging and developing countries could lead the world into a new global financial crisis. Another reason why interest rates need to be lowered quickly.

MAKE-IT CAPITAL FUND (the Fund)

- As a unique hedge fund for a comprehensive blockchain / cryptocurrency portfolio, the Fund allows investors to participate in the full spectrum of distributed ledger/crypto assets with just one investment.

- The Fund set out to reduce inherent risk and volatility by employing its proprietary 5-pillar strategy.

- The Fund is operated by Make-It Singapore and managed by Make-It New Zealand.

- It is open to institutional and accredited investors worldwide.

- Open-end structure with a minimum investment of $50,000.

- The Fund is fully transparent and always trades at the exact NAV.

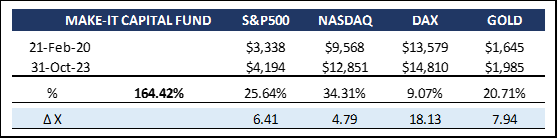

The Fund had its second best month this year and increased its ytd performance to 72%. It could have been even better, but we had a higher than usual allocation to ETH as we expected ETH to outperform BTC. But things turned out differently, as we saw above. Well, you cannot always get everything right. The good news is that ETH is currently outperforming BTC. So we expect to return to outperforming BTC again in November.

Sentiment on Planet Crypto has brightened considerably for a variety of reasons, not least the upcoming approvals for spot ETFs on the major cryptocurrencies. It seems that the snow is melting and we are entering the crypto spring. Especially in a market as volatile as the cryptocurrency market, perseverance is key. Exiting the crypto markets too early usually costs investors dearly. Here are some insightful stories about perseverance:

- In 1999, Larry Page and Sergey Brin wanted to sell Google for $1 million. They were rebuffed (by Excite). Then they considered selling for $750,000. Again, they were rebuffed.

- In 2000, Netflix wanted to sell itself to Blockbuster for $50 million. “They laughed at us,” says Netflix co-founder Marc Randolph. Today, Netflix is worth $190 billion.

- In early 2005, MySpace was interested in acquiring Facebook. Mark Zuckerberg was asking $75 million. MySpace thought the price was too high.

- In 2008, the founders of Airbnb wanted to raise seed money. They wanted $150,000 in exchange for 10% of Airbnb. They sent emails to 7 prominent investors. 5 of them sent back rejections. The other 2 did not respond. Today, a 10% stake in Airbnb is worth more than $8 billion.

Perseverance pays off if you back the right horse. As Wall Street’s massive entry into cryptocurrencies shows, blockchain and crypto investments could dominate the horse race track for a long time to come and promise substantial profits in the future.

From the eternal wisdom of Lao Tzu: “Of all that is good, sublimity is supreme. Succeeding is the coming together of all that is beautiful. Furtherance is the agreement of all that is just. Perseverance is the foundation of all actions.”

Thank you for your time and attention.

Sincerely,

Philipp L.P. von Gottberg

P.S. Here is the promised safe link to the paper co-authored by Vitalik Buterin: Blockchain Privacy and Regulatory Compliance: Towards a Practical Equilibrium: