July 05, 2023

THE WORLD AS WE SAW IT IN JUNE 2023

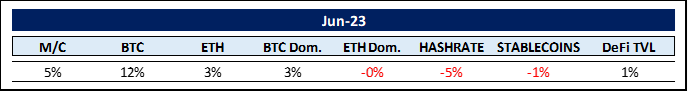

The World of Cryptocurrencies

The world of cryptocurrencies had its third-best month this year adding some $55 billion in market capitalization. Bitcoin (BTC) outshone Ethereum (ETH). Forces driving the former were most prominently the Blackrock news, whereas rumor of an impeding probe of the SEC into DeFi seemed to have hurt the latter. BTC has the upper hand by 14% over ETH ytd and is close to reclaiming a 50% market dominance.

Elsewhere, all the major crypto-related news was circling regulation or an attempt thereof. Here is a concise overview:

Given the successful introduction of MiCA (Markets in Crypto Assets) regulations by the EU, the pressure has been piling on for the US not to lose complete ground through petty “genslering”.

Acting upon the untenable situation, the Committee on Capital Markets Regulation, a trade association comprising entities like JPMorgan, Bank of America, Charles Schwab, and Wells Fargo, among others, blasted the SEC saying its current regulations don’t allow crypto platform compliance. Even Cathie Wood chimed in: “Because of regulatory uncertainty, innovation seems to leave the US for more friendly regimes. Unfortunate. I believe it will become an election-year issue.”

Proposing a much-needed solution, U.S. Congress came forward with a seminal 162-page document leading to headlines such as this one from Forbes: “Congress Introduces A Game-Changing Crypto Bill Amid $350 Billion Bitcoin, Ethereum, BNB And XRP Price Pump”.

What is remarkable is that the “Congress Crypto Bill” (no specific name has been given yet) is a joint effort between two committees in the House of Representatives. The House Financial Services and Agriculture Committees, meaning the SEC and the CFTC. So far, both have claimed hegemony over the crypto fiefdom, declaring cryptos either securities or commodities. Now, they have to find common ground – and do so swiftly.

Moving forward, both the Bank for International Settlements (BIS) and the International Monetary Fund (IMF) independently announced their respective money tokenization moves, wherein real-world assets, from banknotes to commodities, are converted to blockchain-hosted tokens.

Wall Street was not to be outdone. First, the world’s largest asset manager, Blackrock applied to launch a spot Bitcoin ETF called the iShares Bitcoin Trust. I know, this is the 28th time an institution has applied for a spot Bitcoin ETF license. However, this time the tide appears to turn. After all, this is Blackrock with a betting scorecard of 575-1, i.e. they have applied for 578 ETFs so far and have received approval in 575 cases.

The SEC’s primary reasoning for rejecting previous ETF applications seems to be its concerns surrounding market manipulation practices. To counter this, Blackrock has proposed bringing in NASDAQ to enter into a Surveillance-Sharing Agreement (SSA) with an operator of a spot trading platform for Bitcoin. This is expected to mitigate market manipulation by allowing for the sharing of information regarding market trading activity, clearing activity, and customer identification. Well, let’s see. An approval would in any case have a major impact on the price of bitcoin.

In other news, giant JPMorgan Chase & Co went live with euro-denominated payments for its digital stablecoin, JPM Coin. The EDX crypto exchange backed by Fidelity, Charles Schwab, and Citadel Securities began trading. And finally, Taurus, a platform backed by Credit Suisse and Deutsche Bank came to life allowing financial institutions and corporates to issue tokenized assets.

What a month! Here is John Steinbeck: “In early June the world of leaf and blade and flowers explodes, and every sunset is different.”

The playing field seems set. Most participants appear to have become aware of the tremendous stakes at play. Stakes none other than the foundational building blocks of our future societal and financial infrastructure.

The World of Commodities

Fed Chairman Jerome Powell continued Hawkish screeching thus impacting gold prices negatively. Nevertheless, gold is still up 6% for the year vs a -5% decline for silver.

Natural gas prices soared through the roof caused by widespread heat waves. The impromptu twist to the Russian saga had an impact, too. However, despite the 22% rise, natural gas prices are still down -37% for the year.

Despite recessionary fears, Dr. Copper was up 4%. In a recent article in the Washington Post, authors Lars Paulsson and Naureen S. Malik called for the need to renew and adapt the U.S. power grid to accommodate a zero-carbon economy. “It means building grids dense enough to absorb these renewable sources while still achieving the stable frequency that’s vital for the smooth functioning of electrical equipment and electronics. It will also require more high-voltage lines to carry surpluses from regions where the sun is shining and the wind blowing to meet demand elsewhere. Right now, the lack of long-distance transmission means a lot of recently installed renewable capacity is going to waste.” It is estimated that such an upgrade will cost around $21.4 trillion and would require 152 million kilometers of new cables — “enough to stretch from Earth to the Sun” if laid end to end. That implies a surge in copper consumption – eventually. Here is Stanley Druckenmiller on the subject: “Copper is in the tightest position I have ever seen it, (..however..) I am afraid to have a meaningful position in it facing a hard landing.”

Turning to oil. Saudi Arabia requires a price of $81 per barrel of oil to balance its budget according to the IMF. This includes spending for ambitious projects like the $500 billion Neom smart city in northwest Saudi Arabia. It also takes into account the Vision 2030 project – which aims to boost Saudi infrastructure (roads, transportation hubs, and industrial centers) to diversify its economy beyond oil.

As oil prices have been languishing, a mesmerizing tug-of-war is developing in the oil markets. Saudi Arabia announced in June it would unilaterally cut oil production by 1 million bpd starting in July (it has a maximum output of 12 million bdp). That represents 1% of the global supply. This comes on top of an OPEC+ surprise 1.6 million bpd cut in April – now extended through 2024.

In response, non-OPEC members like the U.S., Canada, Norway, Brazil, and Guyana are expected to increase production by 1.5 million bpd in 2023 and 1.3 million bpd in 2024. This will help offset the cuts. But it won’t be enough. The International Energy Agency (IEA) forecasts world oil demand will increase to a record 102.3 million bpd in 2023. That’s up from 99.6 million bpd in 2022. However, 60% of that deemed increase is estimated by the IEA to come from a reinvigorated China (more on that later).

Add to the picture the U.S. Strategic Petroleum Reserve (SPR). In July 2020, the SPR had 656 million barrels of oil. Today, it’s down to 350 million barrels. Earlier this month, the DOE said it bought 3 million barrels of West Texas Intermediate (“WTI”) crude (the U.S. standard) at $73 per barrel to replenish the SPR. The SPR is still 303 million barrels lower than in July 2020 though.

Given all of the above, oil prices should have at least found a floor for now.

The Rest …

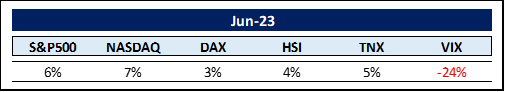

Stock indices continued their staggering climb led by NASDAQ, now up 32% for the year. This half-year performance is the second-best in the index’s history, dating back to its inception in 1985.

The vast majority of this increase still stems from MANTAMAN (Microsoft, Apple, Netflix, Tesla, Amazon, Meta, Alphabet & NVIDIA), i.e. the largest U.S. tech companies – paired with AI excitement. One member of the above group, Apple Inc. made Wall Street history as the first company with a $3 trillion market value. This is the latest sign of big tech’s seemingly unstoppable dominance of equity markets.

Elsewhere, the best-performing international stock markets in June were all in inflation-ridden countries: Zimbabwe +53%, Argentina +25%, and Turkey +21%.

The world is moving at breakneck speeds, and the ghosts of inflation and consequent liquidity-sucking FED behavior seem far from over, yet the investing world is celebrating also exemplified by yet another low in the volatility/fear index VIX.

The Yield Curve has reached its highest inversion level for this cycle at 105 bps (actually this is the highest inversion we have seen in 43 years!). Jerome Powell seems intent on resuming raising rates although inflation figures as per the website truflation came in at 2.3%, i.e. right where they are supposed to be. Will further hikes exacerbate the death of regional banks, will we finally get the ominous recession? I tend to lean toward John Kenneth Galbraith‘s first forecaster: “There are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know.”

As alluded to above, a quick note on China. The latest economic data released this week presented investors with a sobering reality. The economy is slowing down, exports are cooling, and the property market is struggling. Contrary to US and EU markets, The Hang Seng Index (HSI) is down -4% ytd. While U.S. technology companies have added $5 trillion in market cap, their Chinese counterparts lost $300 billion.

The economics professor at the London School of Economics and Political Science, Keyu Jin, has an interesting take: “We have to be prepared for slower growth in the future because China is really in transition right now from industrialization to innovation-based growth.” And: “Innovation-based growth is just not that fast. We’re caught in a kind of vicious circle in the sense that you need a massive stimulus to create a little moderate impact.” Here is the founder of Alibaba Group, Jack Ma: “It is impossible for China to keep 10 – 15% growth annually. The economy needed to slow down, and we have to learn to slow down”.

The world needs to come to terms with China’s seemingly insatiable appetite for commodities to slowly decrease.

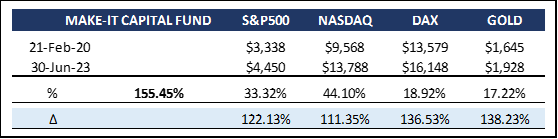

MAKE-IT CAPITAL FUND (the Fund)

- As a unique hedge fund for a comprehensive blockchain / cryptocurrency portfolio, the Fund allows investors to participate in the full spectrum of distributed ledger/crypto assets with just one investment.

- The Fund set out to reduce inherent risk and volatility by employing its proprietary 5-pillar strategy.

- The Fund is operated by Make-It Singapore and managed by Make-It New Zealand.

- It is open to institutional and accredited investors worldwide.

- Open-end structure with a minimum investment of $50,000.

- The Fund is fully transparent and always trades at the exact NAV.

The Make-It Capital Fund continued on its path with another great green month.

We are glad we adhere to our 5-pillar diversification strategy if we hear this from Dr. Leemon Baird, Inventor of Hashgraph, Co-founder of Hedera:

“In the near future, the internet as we know it will fundamentally transform. What is currently a centralized, siloed Web 2.0, will morph into a decentralized, shared, and interconnected Web 3.0, in which artificial intelligence, machine learning, blockchain, and distributed ledger technology (DLT) play an integral role.

Within this decentralized, next-generation internet, almost every asset in the world will eventually be tokenized and represented on distributed ledgers, allowing these assets to be fractionalized, shared, and transferred across the globe instantly and without intermediary involvement. The world will be tokenized. This will happen, and it is already starting to happen now. Just as the invention of computers led to data migrating from paper to databases, these web 3.0 technologies will cause assets to be tokenized, tracked, and traded.”

Or as Alkesh Shah and Andrew Moss of Bank of America recently put it: “We are on the verge of an infrastructure evolution that may reshape how value is transferred, settled, and stored across every industry”.

A view we endorse. Sure, Bitcoin is a core investment – also in the Fund; however, it should only be one’s entry into the space. This reshaped world will run on blockchain technology. That is the reason why we built the Fund as it is today, representing the entire blockchain spectrum (except mining), present and future, as a one-stop-shop to easily participate in and profit from all transformational changes occurring on the path to a tokenized economy.

Thank you for your time and attention.

Sincerely,

Philipp L. P. von Gottberg