March 01, 2023

THE WORLD AS WE SAW IT IN FEBRUARY 2023

The World of Cryptocurrencies

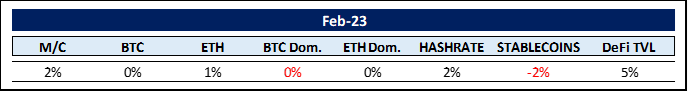

All in all, crypto markets were pretty stable viewed over the entire month. This is quite surprising given the massive regulatory assaults on the industry that will be addressed further down.

The upcoming Shanghai software upgrade on the Ethereum (ETH) blockchain is seen as the catalyst for the rise of liquid staking to $14.1 billion total value locked (TVL). The reason seems to be that the Shanghai upgrade will for the first time enable participants to withdraw the staked ETH instead of having them locked away for prolonged periods of time.

At the G20 meeting in India, International Monetary Fund (IMF) Managing Director Kristalina Georgieva said the IMF was in favor of regulating crypto rather than directly banning it. Well, that is noble as banning it would not work in a decentralized system anyway. This edition’s cover picture exemplifies what especially the US government is trying to achieve: Putting the crypto world in a stranglehold.

Or as Blockchain Association CEO Kristin Smith coined it “carpet bomb” the crypto industry. Be it Coinbase, Kraken, Paxos and Binance – all are being directly attacked by regulatory authorities. As such, the SEC has taken action against core elements of the crypto ecosystem namely staking, stablecoins and qualified custody, on top of the ongoing tedious discussion whether a crypto asset is a security or a commodity or anything in-between.

Nic Carter, of Castle Island Ventures, called the Biden administration’s coordinated, ongoing effort across virtually every US financial regulator to deny crypto firms access to banking services Operation Choke Point 2.0. Nic is referring to the original 2013 Operation Choke Point having cut certain merchants such as online gaming or payday loan platforms out of accessing the financial system. The same strategy seems to be repeated now with regard to the crypto industry. Try to get a bank account if you are a crypto firm.

Further, classifying all proof-of-stake (PoS) networks as securities would have far-reaching consequences as all such networks would be prohibited from being secured. PoS networks from ETH and Cardano, to Solana and Aptos, all rely on users staking a certain amount of coins and tokens to validate network transactions. In exchange stakers receive yield rewards, just like a bank receives interest rates on loans. Except, stakers support an entire network, rather than a single institution such as a bank.

What gives rise for hope though is, the original Operation Choke Point kicked the can in 2017 as it was deemed government overreach.

Perhaps the aim is not to completely destroy the crypto industry but rather shuffle the cards into Wall Street’s favor? After all, why did Citadel just buy a 5.5% stake in formerly prominent crypto bank Silvergate Capital Corporation, the second most shorted stock in the US; not to be outdone by BlackRock increasing its stake to 7.2%?

Don’t get me wrong, at Make-It Capital, we are all for intelligent regulation of the crypto industry, however, carpet bombing does not qualify as such. We ask ourselves, is the government really out there to protect its sheep from malignant players? Somehow, that is in doubt. Rather, control and taxation seem to be prime motifs.

Therefore, regulating any switch from cash to crypto and back, while letting the industry develop better financial systems, would on the one hand allow for control and taxation, and on the other, for the necessary breathing space to develop a much needed worldwide financial reform.

It may be strange, but the next crypto bull run may come from the most crypto-hostile nation in the world – China, specifically the Special Administrative Region of the People’s Republic of China: Hong Kong. Hong Kong’s equivalent to the US SEC, the SFC, proposed a new set of rules that have a “regulate to protect” approach, as opposed to the SEC’s notorious ‘arbitrary sanction by legislative void’ approach. If China indeed nurtures a regulated crypto oasis in Hong Kong, this may be a foreshadowing of a China-driven crypto resurgence.

Or as Cameron Winklevoss of the crypto exchange Gemini put is succinctly: “… the next bull run is going to start in the East. It will be a humbling reminder that Crypto is a global asset class, and that the West, really the US, always only ever had two options: embrace it or be left behind. It can’t be stopped. That we know.”

Adding to the picture is the fact that over 40 million Americans own crypto assets, most of them in the age bracket of 18-35. That’s a lot of votes. There is a most interesting moral, ethical and foremost political and financial tug-of-war developing. Interesting times indeed.

Let’s close this section with a quote from Satoshi Nakamoto, Founder of Bitcoin: “The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.”

We can do better.

The World of Commodities

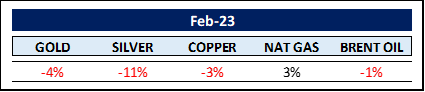

Precious metals had another ugly month responding to the rising US Dollar Index. The Gold/Silver ratio hit 88 which is historically very high.

Dr. Copper continues to slide, having lost 7% in 2023. This is quite astonishing given the historical low inventory levels at exchanges such as the COMEX. In fact, COMEX copper inventories have dropped from their 2018 peak of 253,000 lbs to just 22,332 lbs. That’s a 91% drop. With China reopening rising demand will impact price levels in the not too distant future.

Switching to Energy: According to @TaviCosta, Microsoft still has a higher market cap than the entire energy sector in the S&P 500. Exxon alone produces just as much annual free cash flow as Microsoft. Adding all the other highly profitable energy companies in the S&P 500, we clearly have a market distortion. Thus, either tech companies are still too expensive, or energy stocks remain a bargain… or both.

China is slowly becoming a global force in the liquified natural gas (LNG) space. In its 2023 LNG Report, Shell mentioned that: “China is evolving from being a rapidly growing import market to playing a more flexible role with an increased ability to balance the global LNG market”. This statement by Shell can be cemented by the fact that China resold a whopping 5.5 million tons of LNG last year.

The plan seems simple: Lock in the supplies by signing long-term offtake agreements with producers around the globe and resell the LNG with handsome profit while controlling a large part of the global trade. This is exactly what happened with Russian gas last year. Germany refrained from purchasing any Russian gas directly, only to buy the same gas now from China at elevated prices.

Staying with Russia, here is Ed Morse, global head of commodity research at Citibank: Russia’s invasion of Ukraine on February 24, 2022 resulted in “the most significant set of market dislocations and distortions in energy markets generally speaking that I ever recall”. Russia was exporting much of its crude and petroleum products to Europe, with a much smaller portion going to China, India, and other Asian nations. By the end of 2022, that ratio had completely flipped.

Switching to lithium and rare earths. This is a quote from Ursula von der Leyen – President of the European Commission (Oct. 2022): ““Lithium and rare earths will soon be more important than oil and gas. Our demand for rare earths alone will increase fivefold by 2030. […] We must avoid becoming dependent again, as we did with oil and gas.” Easier said than done.

As Elon Musk put it: “Lithium-ion battery cell supply is the fundamental constraint for the global transition to sustainable energy.” Surfing the alleged green wave, a plethora of countries and corporations will require lithium and rare earths creating a major supply/demand imbalance.

The Rest …

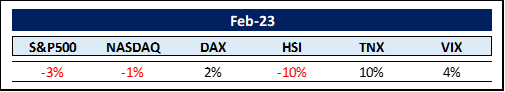

Only two factors seem to determine asset prices these days: The Fed and the US Dollar Index. As the Fed turned around and became more hawkish again in February while the US Dollar index broke its downward trend heading higher, asset classes especially ones correlated to risk suffered. However, despite having dropped 5% intra-month, the NASDAQ is still up 9.45% for the year. Among the largest stock exchanges, the Hang Seng Index was hit hardest shedding 10% in February.

This triggered China’s central bank to ignite it’s single-largest liquidity injection ($92 billion) by means of reverse repurchase contracts on February 17th, to help support its economy out of historically depressed levels. Didn’t help the stock market so far.

However, liquidity that is being sucked out of international markets by Western central bank tightening, seems to be neutralized by Eastern easing.

Although 10 year treasury yields surged 10%, short term rates ran up even higher resulting in a period-record inverted Yield Curve of -89 basis points still indicating a looming recession.

Coming back to the Fed and US Dollar Index, the Congressional Budget Office (CBO) projects the federal debt to explosively balloon to 195% of GDP by 2053. That would earn the US the not-so-coveted silver debt medal just losing out to Japan but clearly beating Greece to third place.

“With so much debt, the long-term bond yields will have to go up to offset the risk of owning them. Yet it’s difficult to imagine how such a debt can be serviced without massively diluting the value of the dollar.”

Of course, the Fed would do so indirectly, by buying more Treasury securities issued by the US Treasury, for example. This would effectively inject more money into the economy for expansionary, inflation-triggering fiscal policies. Thus, we are back to square one with high inflation.

So, despite its current tepid resurgence, the US Dollar as the world’s reserve currency will have to resume its downward trend. After all, it lost 74% in purchasing power since 2000. Long-term this bodes well for any real asset, be it precious metals, Bitcoin, or real estate.

MAKE-IT CAPITAL FUND (the Fund)

- As a unique hedge fund for a comprehensive blockchain / cryptocurrency portfolio, the Fund empowers investors to participate in the entire distributed ledger / crypto-asset spectrum with just one investment.

- The main objective of the Fund is reducing risk and volatility by employing its proprietary 5-pillar strategy.

- The Fund is operated by Make-It Singapore and managed by Make-It New Zealand.

- It is open to institutional and accredited investors world-wide.

- Open-end structure with a minimum investment of $50,000.

- The Fund is fully transparent and always trades at exactly NAV.

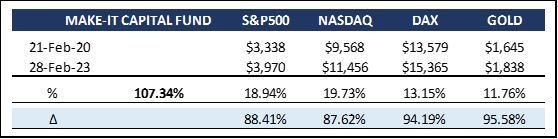

The Fund continues on its path outperforming while demonstrating less volatility measured by lower maximum drawdowns. We have thus not initiated any strategy changes during February.

Here is an amazingly prescient quote from Henry Ford printed in the New York Tribune of December 04, 1921 wherein he propagates a currency system based on energy: “The standard American dollar is approximately 1/20th of an ounce of gold. Under the (energy) currency system, the standard would be a certain amount of energy exerted for one hour that would be equal to one dollar...”.

The gold standard was the basis for the international monetary system from the 1870s up to, with a few war-driven interruptions, 1971. However, Ford viewed this system as prone to governmental manipulation as it could still print all the money it wanted drawing on its “imperishable natural wealth”. Well, ever since Richard Nixon denied Charles de Gaulle a payout of France’s US Dollars in gold from Fort Knox on August 15, 1971, even this last potential restraint to unlimited money printing had vanished.

Remarkably, Ford’s suggestion of an “energy-based” currency is nothing else than Bitcoin. Thousands of Bitcoin miners around the world verify each transaction, which are grouped into blocks, and these data blocks are then added to Bitcoin’s decentralized ledger for posterity. In a way, each bitcoin is an energy receipt issued by a decentralized computing powerhouse.

There are still some obstacles and hurdles especially with regard to regulation and mass adoption. However, it is still very early days for crypto and blockchain technologies, and we remain as optimistic as ever.

After all, as Paul Buchheit, creator of Gmail, posited: “Bitcoin may be the TCP/IP of money”. It was not possible to invest in TCP/IP directly at the dawn of the internet – Bitcoin on the other hand is still affordable. Let’s see for how long.

Thank you for your time and attention.

Sincerely,

Philipp L. P. von Gottberg

PS – should you feel nostalgic and would like to see the original article by Henry Ford, here is the link: