| THE WORLD AS WE SAW IT IN SEPTEMBER 2024 |

| The World of Cryptocurrencies |

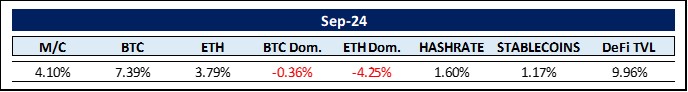

| The Bitcoin price is historically weak in September, reflecting the “September effect” of Wall Street and having been labeled Rektember for that reason. In fact, the Bitcoin price has fallen eight times and risen only three times since 2013, but the September of 2024 has shown positive dynamics rising by $89 billion in total market cap. The Wall Street phenomenon has been well documented for nearly a century. Since 1929, the S&P 500 has fallen 55% of the time in September, according to OpenMarkets, “by far the most of any month and the only month that has fallen at least 50% of the time in the last 94 years”. OpenMarkets’ analysis cites traders’ vacation schedules and financial firms’ seasonal rebalancing as possible factors.Most economists view the September effect as an unexplained anomaly with little relevance. This is partly because it calls into question the efficient market hypothesis, which states that the secondary market price of an asset always reflects all available information. Nevertheless, Bitcoin’s weakness in September was often followed by gains in Q4. Since 2013, Bitcoin’s average 5% drop in September was followed by a 22% rise in October and a 46% jump in November (although this figure is somewhat skewed due to Bitcoin’s 460% rise in October 2013). Nonetheless, the uptrend in the crypto markets commencing with the October bull runs has been aptly dubbed “Uptober“. We would certainly welcome another Uptober.Then in November, the world will be eagerly awaiting the outcome of the US presidential elections. According to a report by broker Bernstein, a Trump victory in November could drive Bitcoin to an all-time high of $90,000. A Harris victory, on the other hand, could push Bitcoin into the $30,000 to $40,000 range. Things are never one-sided, though, are they? New York-based asset management firm VanEck even favors a win for Kamala Harris in November. Their reasoning is that a Harris presidency would continue current economic policies that they believe would weaken the US dollar and encourage Bitcoin adoption. In their view, a Democrat in the White House would be unlikely to solve the current financial problems. The authors of the VanEck report, Matthew Sigel and Patrick Bush, wrote that “we would argue that a Kamala Harris presidency could be even better for Bitcoin than a second Trump term because we believe she would accelerate many of the structural problems that are enabling Bitcoin adoption in the first place.” They further assert that “as inflation and currency debasement continue to challenge fiat money systems, Bitcoin can serve as an important hedge.”On September 20, the U.S. Securities and Exchange Commission (SEC) gave Nasdaq the green light to list and trade call and put options for the iShares Bitcoin Trust (IBIT) — BlackRock’s $22 billion Bitcoin ETF. According to analysts, the introduction of options will make Bitcoin a more functional investment vehicle. The excitement over the approval was tangible. Jeff Park, Head of Alpha Strategies at Bitwise, commented, “We are about to witness the most extraordinary “Vol of Vol” upside move in financial history … Without exaggeration, this marks the biggest advance imaginable for the crypto market.” He continued, “Bitcoin ETF options are the first time the financial world will see regulated leverage on a perpetual commodity that is truly supply-constrained … Things are likely to get wild.” By comparison, options on commodity markets such as oil, cocoa or corn are traded more closely with the futures market because they have expiration dates, which is not the case with Bitcoin.Staying with the SEC: Recent filings show that in the first quarter of 2024, approximately 944 institutional investors with more than $100 million in assets under management purchased one of the available Bitcoin ETFs. By comparison, this is 10 times the number of asset managers that have reported investing in gold ETFs. BlackRock’s IBIT alone attracted 414 institutional investors. Eric Balchunas, a senior ETF analyst at Bloomberg, told Fortune, “It’s absurd. It’s crazy. In a good first 13F season, it would be maybe 10, it’s that hard. But to have 414 is just bonkers”.Let us dive deeper into Bitcoin and gold, this time into their respective ownership structures: according to bitcointreasuries.net and the World Gold Council, there are still massive differences in the ownership structure between Bitcoin and gold holders. Institutions and corporations own around 55% of the world’s gold, while this figure shrinks drastically to 8.7% for Bitcoin. Private households own 29.5% of all gold, while this figure explodes to 89% for Bitcoin. Governments own 15.5% of the available gold, while only 2.3% of all bitcoins are held by state treasuries. It is expected that both institutions and governments will only increase their respective Bitcoin holdings in the medium to long term.Further, data from a 2023 survey of hedge funds shows that 54% of traditional hedge funds are unlikely to invest in cryptocurrencies in the next three years. However, 31% of the same group recognized the tokenization of assets on a blockchain as the most important future market opportunity. A report by Roland Berger entitled Tokenization of Real World Assets (RWAs) predicts that such tokenization will usher in a new era of ownership, trading and investment that will achieve a 27x return to $10 trillion by 2030 redefining asset management.Global asset manager AllianceBernstein (AB) recently took a close look at stablecoins. They found that USDT(Tether), USDC (Circle) and the smaller stablecoins are together the 18th largest holders of US government bonds. AB also noted that “stablecoin usage has decoupled from crypto and is increasingly being held for non-crypto use cases.” While they have traditionally served as a bridge for crypto trading, stablecoins are now also held for non-crypto purposes, such as cross-border payments and savings. Stablecoins, which as a group have grown by 42% year-on-year, are attracting new market entrants. The most prominent example being PayPal, introducing its stablecoin PYUSD, which is already approaching a market capitalization of $750 million. BitGo recently announced its USDS stablecoin pegged to the US dollar, which is due to be launched in January 2025. This follows Coinbase’s launch of cbBTC, a Bitcoin-pegged asset for its Base Layer 2 network. During his fireside chat at the recent Korea Blockchain Week, Brad Garlinghouse, CEO of Ripple, said that his company will launch its new stablecoin in “weeks, not months” And finally, Revolut, a London-based fintech company recently valued at $45 billion, is said to be quite far along in the development of its own stablecoin. Drawing attention to stablecoins in emerging markets: a recent research report by investment firm Castle Island Ventures and hedge fund group Brevan Howard notes that the use of stablecoins for everyday financial matters such as savings, currency conversion and cross-border payments is growing rapidly in emerging markets. The report, which surveyed users in Brazil, Nigeria, Turkey, Indonesia and India, found that 69% of respondents have exchanged their local currency for stablecoins, while 39% of respondents paid for a good/service with stablecoins or sent/received money to a relative in another country with stablecoins. Respondents also confirmed the use of stablecoins as a means of income, with 30% having used stablecoins for their business and 23% having paid or received a salary in stablecoins. If this exponential adoption of stablecoins continues, Orwellian-style government-controlled central bank digital currencies (CBDCs) will not be needed. We will keep our fingers crossed. |

| The World of Commodities |

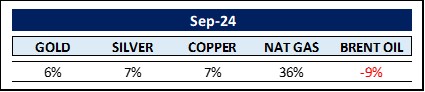

| The weakness of the US dollar is a significant tailwind for the commodities sector, but the clearest signs of support are in precious metals and soft commodities. Sugar (+16% on the month) is recovering in response to a supply disruption related to the Brazilian wildfires, but it is not the only commodity rebounding from oversold levels. Beef has risen by 16%, oats by 18% and sunflower oil by as much as 25% in September alone. Speaking of precious metals, we must draw attention to gold. Gold is hitting record high after record high as investors continue to flock to the traditional safe haven, spurred on by the start of the Fed’s rate-cutting cycle as well as global economic and geopolitical uncertainty. Not only are retail investors buying gold, but central banks have also been stocking up on gold throughout the year, continuing a buying spree that began in 2022. In the first half of the year, central banks bought 483 tons of gold, the most since 2000. In 2000, however, the average gold price was still $279.29 per troy ounce, meaning that this year’s demand has reached an utterly new dimension in US dollar terms. Last year, the proportion of silver used for industrial purposes rose to 55%. 20% of silver is used for silver coins and bars and a further 17% for jewelry. As silver has the highest electrical conductivity of all metals, demand from the electronics industry has risen sharply recently, particularly as a result of the AI boom. However, silver is also increasingly in demand in a completely different area. This year, demand from the renewable energy sector has already reached a new record level and accounts for more than 20% of the silver produced worldwide. Some experts predict that demand from the renewable energy sector will rise to 90% by 2050. Be that as it may, silver appears to offer some attractive characteristics as a long-term investment. Turning to the oil market. ExxonMobil (Exxon) sees oil consumption in 2050 at the current level (103 million barrels per day). Exxon’s forecasts are roughly in line with other current forecasts by participants in the oil industry. OPEC predicts consumption of 116 million barrels per day (mb/d) in 2045, while pipeline giant Enbridge Inc. predicts demand of over 110 mb/d. Exxon’s director of economics and energy, Chris Birdsall, said demand will be so high that it would be “disastrous” not to invest in new fossil fuel projects now. Without new investment, Exxon sees oil supply falling significantly, which would drive up crude prices and decimate the global economy. “We feel like we have to come out strong with that message because there are activists that are pushing a keep-it-in-the-ground approach,” … “We can point to places where that’s starting to leak into policy. That’s really dangerous.” This is not a repeat of the early 2000s. Back then, there were real fears that the world would run out of cheap oil. The revolution in unconventional oil wells and deep-water drilling has significantly increased the amount of oil available at prices between $30 and $80. The fact that gasoline prices are a major topic of conversation every time they rise suggests that we are still a long way from a cessation of new drilling. Nevertheless, any attempt to significantly increase production will be met with considerable resistance. At the moment, however, oil prices are falling as Saudi Arabia is determined to start unwinding voluntary production cuts starting Dec. 1, even if it leads to a “prolonged period” of lower crude prices. Saudi Arabia is ready to abandon its unofficial price target of $100 a barrel for crude in order to regain market share. A/S Global Risk Management commented in a report. “We assess that the Saudis are trying to put significant pressure on the quota cheaters.” The only way to instill discipline on OPEC quota cheaters (notably Iraq, Nigeria, Kazakhstan and Russia) is to increase supply and drive their respective production into the red. This means a degree of self-sacrifice for Saudi Arabia, as it will have to absorb lower prices. Adding to this is weakening demand as Chinese oil demand is currently firmly in contraction down 1.7% year-over-year, or 280,000 barrels per day. This is a sharp contrast with the average growth of 9.6% seen in 2023. We’ll see how this will play out. One of the most interesting albeit controversial raw materials in the energy sector at the moment is uranium. In a trailblazing move, 14 of the world’s largest banks – including Bank of America , Citi, Goldman Sachs, Morgan Stanley and Barclays – have recently pledged to support the financing of nuclear energy. The goal is to triple the world’s nuclear power generation capacity by 2050 – a truly groundbreaking endeavor. Financing is one of the two biggest problems that need to be solved for nuclear energy projects, the other of course being the regulatory hurdles. The politics surrounding nuclear energy are so controversial that banks are often reluctant to invest for fear of negative press. Solar and wind energy though will simply not suffice to meet our growing base load demand. The only alternative seems to be a renaissance of nuclear fission, which shall be replaced by nuclear fusion as soon as it can be deployed economically. Uranium prices are likely to continue to have a strong tailwind going forward. As spot prices are a derivative of term prices, it makes a lot of sense to review term prices regularly to get an idea of the possible development of spot prices. Do you remember the biggest nuclear disaster in the US? That notoriety belongs to Three Mile Island (TMI) near Harrisburg, Pennsylvania. In March 1979, a complete reactor meltdown occurred in the second reactor, TMI-2, due to a malfunction of some electrical and mechanical signals. However, TMI-1 continued to produce energy until 2019 and was then decommissioned. Now the owner of TMI-1, Constellation Energy (CEG), has announced that it has signed a power purchase agreement with a partner to bring Three Mile Island back to life. The partner is none other than Microsoft – the second largest company in the world by market capitalization – which has agreed to purchase 100% of TMI-1’s power for 20 years. This equates to around 835 megawatts of clean electricity production per year – enough to power around 750,000 homes. Microsoft intends to use the energy to power its existing and future data centers where artificial intelligence is trained and operated. Commenting on the Microsoft contract, Joseph Dominguez, President and CEO of CEG, said: “The energy industry cannot be the reason China or Russia beats us in AI. This power plant should never have been shut down… It will produce as much clean energy as all the renewables [wind and solar] that have been built in Pennsylvania in the last 30 years.“ |

| The Rest … |

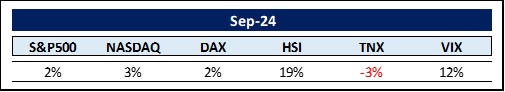

The most notable move in share prices in September came out of China, where equities exploded following the latest easing announcements from the People’s Bank of China (PBoC). But more on that later.

First, we must draw attention to other developments in China, as the country has been actively trying to combat a ‘hedonistic lifestyle‘, particularly in the financial sector and among wealthy individuals. The Chinese authorities have taken various measures to curb the display of wealth and discourage excessive lifestyles. For example, financial companies have been instructed to restrict the display of wealth, such as posting photos of luxury goods on social media or wearing expensive clothes to work. This restriction has led many Chinese strivers astray. Instead of being rewarded for working long hours and taking risks, they face pay cuts, layoffs and government attacks on what they consider their basic lifestyle. This is a gross oversimplification, but it underscores a serious problem for China and, indirectly, the world. At least three senior investment bankers from various securities firms have been arrested by the Chinese authorities since August. The malaise of many of China’s best-educated workers could exacerbate the gloomy mood in China’s $18 trillion economy.

Prior to the very recent rise, the Chinese stock market has been underperforming its global peers, with consumer spending at its weakest level since the pandemic, and deflation showing signs of spiraling. There is also a sense of stagnation in China’s sprawling government bureaucracy and state-owned enterprises, as employees see limited opportunities to take the initiative and unlimited downside if things go wrong. The attack on the earning power of the wealthier and emerging segment of the economy is one of the most blatantly anti-capitalist measures taken by the Xi government. They suggest that living standards and spending plans will have to be cut. Where will this lead? Back to full-blown communism or is this perhaps part of the strategy to regain global supremacy by what Michael Pillsbury calls the Chinese 100-Year Marathon in his book of the same name?

Anyhow, to support local stock markets, PBoC Governor Pan Gongsheng has just announced that the central bank will set up a government-sponsored stabilization fund. The measures include interest and mortgage rate cuts, the release of cash to banks and liquidity support for equities. Empirical research on the world’s major equity markets has shown that direct government support for the equity market has proven effective in breaking a negative spiral, warding off systemic risk and boosting valuations in the short term. Goldman Sachs estimates that this potential China stabilization fund could ultimately be worth up to Rmb44 trillion ($6.3 trillion).

As alluded to above, the announcement sparked the biggest rally in Chinese equity markets in a long time, sending the HSI up 19% this month. Where this will lead in the long term is anyone’s guess. For now, however, Chinese markets are closed until October 8 to celebrate China’s golden week holiday.

On to Brazil’s latest monetary policy measures. Are they a harbinger of what is to come in the US and Europe? In contrast to the start of monetary easing in the US and Europe, the Brazilian Central Bank’s Monetary Policy Committee (COPOM) has raised the SELIC’s key interest rate from 10.5% to 10.75% for the first time since August 2022. Now that the US Federal Reserve and the European Central Bank have started to cut interest rates, the question for investors is how far they will eventually cut rates before they have to raise them again

The Brazilian government began cutting rates in July 2023 (at 13.75%) stopping in May (at 10.50%). As economic activity is picking up again, it is very likely that interest rates have not reached a higher floor. This is an important potential outcome for several other markets as well. The COPOM gave no indication of next steps, but emphasized that the pace of future adjustments and the cycle will depend on inflation dynamics. It remains to be seen how the US and European central banks will react when inflation rears its ugly head again.

Let’s dig deeper into the current fiscal and monetary situation in the US. Almost $200,000 per second, $12 million per minute – that’s how much money the US government is currently spending. In the past twelve months, it has spent a total of $6.2 trillion. But more than a quarter of this, around $1.7 trillion, has been uncovered. That’s how much new debt the USA has incurred in one year. Larry Fink, head of the investment giant Blackrock, recently said he cannot remember the country’s debt situation ever being more difficult. Earlier, the founder of financial services provider Citadel, Ken Gryphon, had warned that US liabilities were “a growing problem that must not be overlooked“. Former Treasury Secretary Robert Rubin, who served under President Bill Clinton, had already said in January that the country was in a “terrible situation“. As of June 2024, the US debt amounts to around 124% of gross domestic product (GDP). The gigantic budget deficits in the US are not an issue for either Kamala Harris or Donald Trump in this year’s elections. “Neither party sees this as an urgent problem,” says Mahmood Pradhan, who worked for as an economist at the International Monetary Fund (IMF) and now analyzes macroeconomic developments at financial services provider Amundi.

According to the Congressional Budget Office, the US government’s interest payments totaled $663 billion or 2.4% of GDP last year, and the amount is expected to double by 2032. “There is no way out of this messy situation in sight,” says Jan Viebig, chief investment strategist at investment company Oddo BHF. “The world could take a more relaxed view if the USA were not the world’s leading economic power and guardian of the world’s reserve currency.” However, this status of the dollar is what makes the debt policy possible in the first place. Investors from all over the world are bringing their money to the US, investing it in the local government’s IOUs – and have not yet been deterred by the high level of debt already accumulated. For Mahmood Pradhan, there are two main reasons for this. “One is a very large capital market that can absorb the savings of practically the entire world” – 60% of the global equity market capitalization is accounted for by the US (up from 43% in 2023). “And the second is the full convertibility of the dollar.” Investors can exchange and withdraw their money at any time. “It would take a very significant event for the world to turn away from the dollar,” Pradhan therefore believes – and at the same time sees a possible scenario for exactly that: “A real risk comes from the frozen Russian currency reserves. Should the West actually confiscate these and transfer them to the victims of the Russian wars, this could have serious consequences. It would set a precedent and could prompt other dictators to withdraw their money from the dollar. “I am really worried about that,” says Pradhan.

Staying with Russia, Alex Kimani from oilprice.com analyzed Vladimir Putin’s recent statements regarding its strategic commodity assets: “Russia is the leader in strategic reserves of raw materials such as uranium, titanium and nickel”. As Western sanctions restrict the export of some Russian commodities such as diamonds, “maybe we should also think about restrictions,” Putin said, adding that such restrictions should not harm Russia. The risk Russia is taking is the same one China took when it restricted the supply of rare earth metals. Such action encourages other countries to build up their own stocks. This is very costly, so progress in the West is slow, and no country wants to do everything themselves. In the long run, however, any country that artificially restricts free trade, whether through supply embargoes or arbitrary tariffs, usually shoots itself in the foot. The French king Louis XIV, under the influence of his finance minister Jean-Baptiste Colbert, who implemented extensive economic reforms in the 17th century to strengthen the French economy through mercantilism, experienced how such trade restrictions can backfire. Certain elements of the current political campaigns in the US should perhaps examine the medium to long-term outcomes of any mercantilist endeavors before blindly implementing them.

MAKE-IT CAPITAL FUND (the Fund)

- As a unique hedge fund for a comprehensive blockchain / cryptocurrency portfolio, the Fund allows investors to participate in the full spectrum of distributed ledger / crypto assets with just one investment.

- The Fund aims to reduce inherent risk and volatility without compromising performance by applying its proprietary 5-pillar strategy.

- The Fund is operated by Make-It Singapore and managed by Make-It New Zealand.

- The Fund is fully transparent and always trades at the exact NAV.

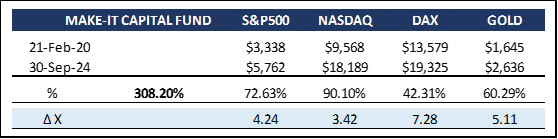

The Fund has performed well. We still have a large position in Ethereum (ETH), which is currently lagging behind Bitcoin. Even though we do not share the extremely bullish view on ETH by VanEck that we examined in Make-It Capital Edition #41 (remember – ETH to $22,000?), we are still very positive on ETH in the medium term. The other pillars, such as our cash generation segment is building delta neutral positions while collecting funding fees and the arbitrage business is also healthy.

As from day 1 of the Fund, we still advocate to allocate between 1-5% of one’s liquidity into this market. “Diversification is a safety factor that is essential because we should be humble enough to admit we can be wrong”. – John Templeton. Due to cryptos having been the best preforming assets class, our personal allocation ratio is now heavily skewed – however, we have no intention of selling.

Bitcoin broke out during its historically worst month: September. Would it have performed similarly if August had been better than -9% for BTC and even -22% for Ethereum? Who knows for sure? Either way, market sentiment, as measured by volatility and the Greed and Fear Index, is healthy. As Augustine Fan, Head of Insights, SOFA.org, commented, investor sentiment seems to be shifting towards “buy the dip” and the risk-reward ratio favors a continued rally albeit there still remain some downside catalysts with regard to global geopolitical risks.

In a recent interview with Bernstein, CleanSpark CEO Zach Bradford said that we could see Bitcoin peak just below $200,000 in the next 18 months. He added that the upcoming US presidential election could play an important role in this price movement, as the post-election period typically brings stability, reduces market nervousness and creates an environment conducive to Bitcoin’s growth (should we have a clear winner – I might add). Anyhow, in his view: “It’s less about who wins and more about the election being over, which brings certainty.”

I’d like to close with Jeremy Allaire’s, CEO of Circle (USDC) recent statement: “I have been building Circle for over 11 years, and at no time have I been more optimistic than right now.”

Thank you for your time and attention

Sincerely,

Philipp L.P. von Gottberg