| THE WORLD AS WE SAW IT IN MARCH 2025 |

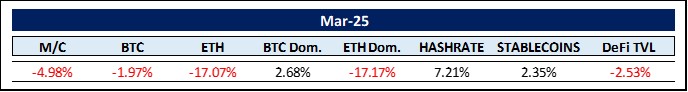

| The World of Cryptocurrencies |

Bitcoin has delivered strong Q1 performances in the past, averaging a return of +51.62% since 2013. Ethereum has been even more impressive, with an average Q1 gain of +78.23% since 2017. In contrast, in Q1’25 Bitcoin is down by around -11.6%, while Ethereum fell by a sobering -46.98%. Overall, cryptocurrencies recorded their weakest first quarter since 2020, when they fell significantly in the wake of the global market turmoil triggered by the global reaction to the COVID-19 pandemic. Due to the higher market capitalization of the crypto market, the loss in nominal terms in Q1’05 was the highest in history of digital assets at roughly -$700 billion. Well, I guess Heraclitus got this right about 500 BCE: “The only constant is change; all things flow, nothing abides. Volatility is the breath of existence, revealing the impermanence beneath our illusions of stability.”

Or do you remember Q1 2018? Bitcoin fell from $13,412.44 on January 1 to $6,928.85 by March 31 — a drop of over -48% that wiped out $119.9 billion in market capitalization. According to CoinMarketCap, the total market capitalization of cryptocurrencies fell by more than -50% due to regulatory crackdowns in China and South Korea, SEC scrutiny in the US and advertising bans from Google, Facebook and Twitter. Ethereum (ETH) fell by -47.7% and Ripple (XRP) plummeted by -77%, making it the worst performer among the major coins that quarter.

To assuage beaten down investor nerves, may I quote Benjamin Graham at this point: “In the short run, the market is a voting machine, but in the long run, it is a weighing machine.” What he meant by this is markets can be emotional and erratic short-term but eventually reflect an asset’s true worth. It’s a call to focus on the fundamentals.

So, let’s delve into some fundamentals. Cumulatively all spot BTC ETFs saw net outflows amounting to -$697 million in March, while spot ETH ETFs endured proportionately higher net outflows of -$410 million for the month. While ETH ETFS experienced an uninterrupted string of net outflows from March 5 to March 27, ETH might have turned the corner on March 28 with a modest inflow of $4.7 million, Bitcoin has been at the forefront again with a string of continuous net inflows between March 14 and March 27, indicating strong accumulation. This is mirrored by major purchases recorded on BTC whale wallets (around 1,750 wallets holding 1,000 BTC or more). These are the same whales that sold bitcoin in droves when it hit the $100,000 mark. The last time we saw such concentrated buying from whales was in early October 2024, when the price was around $60,000. One should never rejoice too soon, but this accumulation could be a harbinger that things are seriously on the up again.

According to a report by River, a BTC financial services company run by Alexander Leishman, the US has one of the highest Bitcoin adoption rates of among individuals at 14%. In contrast, the global adoption rate is significantly lower: according to River’s analysis, only about 4% of the world’s population owns Bitcoin. This global estimate reflects the wide range of adoption in different regions. In South America, for example, the adoption rate is 6.6%, in Asia 3.6%, in Europe 3.4%, in Oceania 3.3% and in Africa 1.6%. These figures suggest that the adoption of Bitcoin is still in its infancy globally, with the US far ahead of most other regions. In conclusion, River estimates that BTC has only reached 3% of its maximum adoption potential — a sign that the digital currency is at an early stage of global embracing and still has tremendous potential for further price appreciation.

US Treasury Secretary Scott Bessent said at the White House Crypto Summit on March 7 that the US government will use stablecoins to ensure that the US dollar remains the global reserve currency. Overcollateralized stablecoins, which use short-term US treasury bills and cash deposits to back their digital fiat tokens and thus drive demand for US debt securities, have been touted to prolong the dominance of the US dollar. To this end, two acts were introduced in March towards establishing a regulatory framework for stablecoins in 2025. The STABLE Act of 2025 and the GENIUS Act (I’ll stick with the acronyms…). While they differ in scope, approach and specifics, they share the common goal of creating a clear, secure framework for stablecoins. The long overdue creation of such a regulatory framework takes precedence over other measures, as it would have a direct impact on US debt. The two major stablecoins USDT and USDC together already hold about $170 billion in US government bonds. By comparison, this is roughly equivalent to the number of government bonds held by countries such as Saudi Arabia, Brazil and Norway. As soon as stablecoin regulations have gone through all the necessary instances, a stablecoin tsunami is likely to occur. It would not be surprising if the total value of all stablecoins surpassed the $1 trillion mark (from roughly $240 billion right now) just in the remainder of the year.

The tokenized real world assets (RWAs) sector surpassed the $10 billion mark in total value locked (TVL) for the first time in March. With the growth in TVL, the RWA sector has become the best performing segment of the crypto market this year. The growth in TVL of RWA protocols already is impressive. Compared to March 2023, when the TVL of RWA protocols was less than $1 billion, the jump is exponential, reaching 1,054% growth in two years. BlackRock’s tokenized money fund BUIDL leads the market with over $1.4 billion TVL and has grown by 140% in the last 30 days. The growth of BUIDL and the Ethena Labs stablecoin USDtb is directly related, as USDtb holds 90% of its backing in BUIDL shares. According to USDtb’s transparency page, over $1 billion of its funding consists of BUIDL. As a result, nearly 76% of BUIDL is powered by a DeFi application, suggesting future linkages between RWAs and DeFi. Patrick Scott from DefiLlama comments: “Hyper-tokenization isn’t a theory; it is already happening. The question isn’t if more assets will be tokenized, but how fast it will scale.”

The market capitalization of tokenized gold has caught up with BUIDL and also reached a record $ 1.4 billion in March, with Tether’s XAUT and Paxos’ PAXG leading the market. In very recent news, $6 trillion AUM financial giant Fidelity announced it will be adding its own tokenized real-world assets fund to the fray. The plan is to launch Ethereum-based shares of its Treasury Digital money market fund for institutional investors. The shares are called, appropriately, OnChain. Fidelity follows UBS, BlackRock, and Franklin Templeton in establishing a tokenized investment product, with many more to follow. We will return to RWAs in Section 3 – The Rest – as tokenization may just be the long-sought-after solution to an ever-growing economic conundrum.

Per a recent report by the broker Bernstein, the share of US Bitcoin mining companies in the hashrate of the Bitcoin network is growing. As a reminder, hashrate refers to the total computing power used to mine and process transactions on a proof-of-work blockchain and is an indicator of competition in the industry and the difficulty of mining. This amount of computing power for Bitcoin is measured by the number of potential hashes created per second. A hash is simply a combination of letters and numbers. If a miner guesses the correct combination, they are rewarded with Bitcoin. Currently, around 850 quintillion hashes are created per second in the network. By comparison, the energy required to perform all these calculations is around seven times the energy required to run Google as a whole. Quite mind-boggling. Bernstein specifically mentioned IREN, whose hashrate is growing the fastest, followed by CleanSpark, Riot Platforms and MARA Holdings. Together, these companies now account for 29% of the Bitcoin network, up from 20% a year ago.

In 2021, El Salvador was the first country to introduce Bitcoin as legal tender. This move was intended to promote financial inclusion and attract investment using cryptocurrency technology. To receive a $1.4 billion loan from the International Monetary Fund (IMF), El Salvador has now agreed to amend its Bitcoin law. The changes include the removal of mandatory acceptance of Bitcoin by merchants, the cessation of tax payments in Bitcoin and the closure of the government-backed Chivo wallet, ending Bitcoin’s legal tender status in the country. Does the IMF want to nip in the bud any attempts to use Bitcoin or other cryptocurrencies as a means of payment? That clearly seems to be the case, and a big question mark remains as to its ultimate reasoning. However, please note that El Salvador can still add bitcoin to its treasury if it so wishes (and it does). Sir Thomas Gresham, meanwhile, would be utterly unfathomed by the IMF’s apparent stranglehold. The English financier introduced the concept of “bad money drives out good money” as early as in the 16th century. By this he meant that people tended to spend “bad money” and keep the “good money“. In this context, bad money refers to money that is worth less than its face value. In historical contexts, this includes, for example, coins made of base metals such as copper or debased gold and silver (where the metal content is less than the face value of the coin). Good money, on the other hand, is money with an intrinsic value that is equal to or higher than its face value, such as coins made of precious metals, where the metal itself is worth at least as much as the face value of the coin. If both “bad” and “good” money with the same face value are in circulation, people tend to hoard the good money (because it is more valuable) and spend or pass on the bad money. This behavior leads to the good money disappearing from circulation and only the bad money remaining in use. Here, Bitcoin can be considered “good money” because it is seen as valuable, is a hedge against inflation, is decentralized, has a limited supply and is accepted worldwide. Fiat currencies, on the other hand, are subject to inflation and the monetary policy decisions of the Federal Reserve (in El Salvador, the US dollar is the official currency). Sir Thomas’ theory, also known as Gresham’s Law, that bad money (fiat) drives out good money (bitcoin), seems to be very much alive, albeit not as intended by the IMF …

The World of Commodities

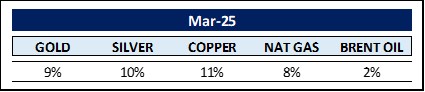

The gold price has reached 50 all-time highs in the last 12 months, the best streak in 12 years. This is also the third longest streak in the history of the gold price after a historic rise in the late 1970s. The 1970s were characterized by double-digit inflation, stagnant economic growth and a high unemployment rate, also known as stagflation. Let’s hope we are not heading there.

Speaking about gold, gold bullion deliveries into New York depositories, especially from Switzerland, which we wrote about in Edition #46 are still rushing in. Gold inventories on the New York Commodity Exchange (COMEX) rose another 25% in February, following a 43% increase in January. Inventories on the COMEX reached a record 42.6 million ounces in March, almost double the level at the end of 2024. One can surmise that stockpiles have skyrocketed due to fears that precious metals could be hit by the Trump administration’s sweeping tariffs. This demand has driven up prices and also created an arbitrage opportunity prompting traders to purchase physical precious metal. All of this will most likely lead to a record trade deficit as higher gold imports have a direct impact on the trade balance. As a reminder, the trade deficit is the difference between a country’s exports and imports of goods and services, and gold is classified as a good in the international trade accounts. Unlike financial assets or investments, physical gold imports are recorded as a debit on the current account reducing the overall trade balance. We will take up the trade deficit again below in Section 3 – The Rest – when we deal with Triffin’s Paradox and the Dutch disease.

Does the extreme increase in physical gold imports into the US also have an impact on the silver market, one might ask? If history is any guide, rising gold inventories in the US will likely drive silver prices higher through correlation and a weaker dollar, but silver’s reaction could be mitigated or amplified by its industrial exposure and market dynamics. Historically, during gold bull markets (e.g. Oct. 2008 – Aug. 2011), the silver price has often risen in tandem with the gold price, sometimes even outpacing the gold price in percentage terms. If we add the out-of-whack gold-silver ratio (GSR) into the picture, silver seems ripe for some serious upward moves. The average GSR over the last 50 years is about 60:1. The current GSR is about 89:1, so for silver just to catch up to this historical average, it would have to rise from its current $34 to about $50, ceteris paribus.

What about copper? For decades, the price of copper traded on the London Metal Exchange (LME) was between 21.5 and 22.5 times the price traded on the COMEX in the US. The enormous price difference is due to the fact that copper is traded in US dollars per metric ton (MT) on the LME, while copper is traded in US dollars per pound (lb) on the COMEX. What is telling is that the ratio today is below 20 times. This shows that the significant outperformance of the COMEX price is a direct result of the 25% tariffs imposed by President Trump on copper imports. The aim is to boost domestic copper production. The problem, however, is that the US only produces about half of the refined copper it needs. This means that the US needs to double its refining capacity if the President’s targets are to be met. As this refining capacity is not currently available, the copper price on the COMEX is rising much faster than on the LME. This is creating an artificial demand for the metal in the US. The tariff rate is 25% on imports, so one can assume that the COMEX price will rise to reflect this arbitrage.

Arabica coffee prices have been on a tear, hitting an all-time high of $422 USD/Lbs. this month due to weak harvests in Brazil and Vietnam. With global consumption at around 2.25 billion cups per day, this unprecedented price level has brought the black market onto the scene initiating a wave of coffee bean thefts across the US – warehouses raided, trucks hijacked and even retail smash-and-grabs. It feels like a throwback to the days of prohibition, only for caffeine addicts, and shows how commodity spikes can trigger outright crime waves.

The top three commodities in March 2025 were Cobalt (+46%), Rhodium (+20%), followed by above analyzed Copper (+11%). The bottom three start with Eggs (-63%), followed by Orange Juice(-23%) and Milk (-8%).

The Rest …

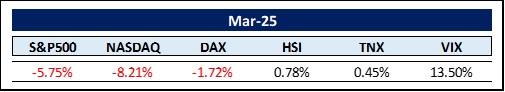

US stock markets, especially the S&P500 (-5%) and the NASDAQ (-10%), have taken it on the chin in Q1’25. All in all, US markets lost between $5 – 6 trillion in the first quarter. Sentiment is poor. The American Association of Individual Investors (AAII) sentiment survey hit 60.6% – one of the highest bearish readings ever. Normally there is a dichotomy between retail and professional investors. This time around, however, professional investors are also afraid. This is according to the Bank of America Global Fund Manager Survey. In this monthly survey, several hundred professional asset managers are asked what they see on the horizon for financial markets. In February, this group had an overweight of around 20% in US equities. In March, they sold off in a big way and moved to an underweight position of around 20% in US equities. Such a pervasive bear market is usually a sign of a market bottom, even if it is only temporary.

Not surprisingly, money market assets have skyrocketed: Nearly $7 trillion now sits in money market funds, more than double the roughly $3 trillion in 2018. It’s important to note that this number is getting higher over time. But each time the flight to safety has skyrocketed like this, it has been following by a big move back into equities and now cryptocurrencies.

Currently, however, markets seem to be hanging on Donald Trump‘s every word, and if he even begins to utter the word ‘tariffs’, the all-pervasive negative sentiment continues to run its cause. Let’s add another dimension.

In view of the recent rumors surrounding the introduction of tariffs also on financial assets, i.e. a new tax on foreign investments in US assets, we need to delve deeper to get a clearer picture. The disadvantage of running the world’s reserve currency (over 60% of global reserves are held in US dollars) is the ever-increasing demand for the US dollar, which is driving up its value against other currencies. This in turn makes US exports more expensive, if not utterly uncompetitive. This is one of the main reasons for the US trade deficit of around $1 trillion in 2024 alone. These effects were already formulated in the 1960s by the Belgian-American economist Robert Triffin (Triffin’s Paradox). The idea of introducing taxes on foreign investments is also not new, as it first emerged in 2019. The basic idea is to monetize the dominance of the US in the global financial markets by introducing the above-mentioned tax to offset the trade deficit. The introduction of such a tax sounds very scary though and could have unintended consequences. A better solution to reduce the demand for US dollars would be to tokenize US assets such as bonds and stocks. These would be traded against stablecoins. Now you might say: wait a minute, stablecoins are normally backed by US dollars, so the demand for US dollars wouldn’t fall. But that’s not true, because stablecoins are not directly backed by US dollars, but by US government bonds. Therefore, the demand for US government bonds would increase, which would lower interest rates and at the same time reduce pressure on the US dollar – killing two birds with one stone. No wonder people like Blackrock’s Larry Fink are so excited about RWAs (real world asset tokenization) and see it as a potential $30 trillion market. The bottom line is that introducing a tax on foreign investment seems like a really bad idea, while RWAs offer a much smarter solution to Triffin’s Paradox.

Another take on a reserve-currency induced trade deficit comes from the Netherlands. In 1959, the Netherlands discovered large gas reserves in the Groningen gas field and became a major gas exporter. The conversion of global gas revenues into guilders led to an increase in the exchange rate, making other exporting industries uncompetitive. Dutch manufacturing declined in a chain of reactions that later became known as the “Dutch disease“. Given the status of the US dollar as the de facto world reserve currency, one might be inclined to call this reserve status the “Dollar disease“, affecting the US trade balance and thus local production. Donald Trump must now reconcile two opposing forces: the ongoing economic force leading to the decline of manufacturing and the strategic need to rebuild manufacturing to prepare for the coming multipolar world. 16th century mercantilist tariffs will most certainly backfire as was the case with the steel tariffs introduced in 2018. Instead of starting trade wars, deeper international cooperation might be more fruitful.

The most important influence on the development of the US dollar as the world’s reserve currency probably began in July 1974, when US Treasury Secretary William Simon traveled to Jeddah, a coastal city in Saudi Arabia, to follow up on a strategic cooperation agreement that Henry Kissinger and Saudi Prince Fahd had concluded a month earlier. With the US now buying millions of barrels of oil from Saudi Arabia, Simon suggested that it might make sense to invest the new wealth in US government bonds and military equipment. The agreement, which had been kept secret for decades, marked the birth of the dollar-based global trading system. Through the leverage effect of the oil trade, the US dollar became the backbone of global cooperation. Today, most commodities are traded in dollars – oil, gas, gold, silver, soybeans, wheat, rice, orange juice, coffee… Industrial goods – machine parts and pharmaceutical products – are also priced in dollars. It doesn’t matter if your trading partner is the US or not, you need dollars to trade. That’s why central banks around the world have started accumulating dollar reserves to keep their economies liquid. As global trade expanded exponentially, so did the need for foreign exchange reserves, driving the dollar even higher. According to the latest data from the IMF – COFER (Currency Composition of Official Foreign Exchange Reserves), banks worldwide have bought around $7 trillion as currency reserves (out of $12.3 trillion in all currencies), thereby influencing both the yields on US bonds and the dollar exchange rate. Even as the US trade deficit with the rest of the world widened, the exchange rate did not adjust. American consumers benefited, but the competitiveness of the US manufacturing sector sank and sank. Hence Trump’s infatuation with tariffs as a panacea for all trade woes. Unfortunately, history has shown that tariffs backfire in the medium to long term. Again, tokenization of real world assets could take a lot of pressure off the US dollar without causing unforeseen negative consequences.

Nearly as important as every utterance leaving Donald Trump’s lips, are the decisions by the Federal Reserve (Fed). Since March 2022, the Fed has reduced the size of its balance sheet. The peak was just under $9 trillion, and the current level is about $6.76 trillion. Jerome Powell mentioned that the Fed looks at the size of its balance sheet in relation to the size of the economy. By this metric, the ratio has returned to levels similar to 2017 and even 2013. From this perspective, the Fed probably believes that it has almost achieved its goal of reducing excess liquidity. In the past two examples of quantitative tightening by the European Central Bank (ECB) and the Fed respectively, bond yields initially rose and then fell to new lows. Quantitative tightening created deflationary forces. In this case, there was no deflation, even though inflation has fallen somewhat. The main reason for this is the fiscal stimulus enacted in response to the pandemic, which has been boosted by increased government spending in general. Government deficits were so high that they exceeded the effect of the Fed’s quantitative tightening. Therefore, the Fed cannot cut interest rates while inflation threatens to return due to such record government spending. In fact, US government spending in the first five months of fiscal year (FY) 2025 was $3.039 trillion, significantly higher than the previous three years: 13.2% higher than FY 2024 ($2.684T trillion, 17.8% above FY 2023 ($2.58 trillion) and 15.8% higher than FY 2022 ($2.625 trillion). This makes FY 2025 the highest spending year in the period, suggesting that the annual total will reach a record high if the trend continues. Add to that the latest inflation figures and one should realize that perhaps it might be time to take off the rose-tinted glasses and look at reality: Interest rates are not going to normalize anytime soon.

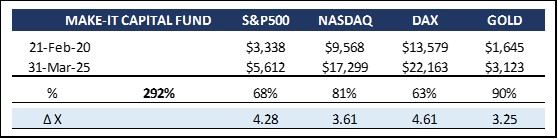

MAKE-IT CAPITAL FUND (the Fund)

| As a unique hedge fund for a comprehensive blockchain / cryptocurrency portfolio, the Fund allows investors to participate in the full spectrum of distributed ledger / crypto assets with just one investment. The Fund aims to reduce inherent risk and volatility without compromising performance by applying its proprietary 5-pillar strategy. The Fund is operated by Make-It Singapore and managed by Make-It New Zealand. The Fund is fully transparent and always trades at the exact NAV. |

The Fund cannot completely escape a negatively impaired volatile down market. Unfortunately, these volatile swings are still typical of the digital assets markets. One needs to overcome emotionally driven reactions and keep the big picture in mind. This is sometimes difficult as it feels counterintuitive. We endeavor to emulate investment legend Peter Lynch: “The key to making money in stocks [or cryptos] is not to get scared out of them.” Lynch (like many other successful long-term investors) always emphasized the importance of emotional resilience, suggesting that fear-driven selling often leads to missed gains over the long term.

There is even a study by Morningstar that examines this. Selling and waiting for the storm to pass should always make sense, but has apparently proven to be detrimental in the past. Markets tend to rise over time despite gloomy headlines, negative events and dark prophecies. And why? People, companies and nations adapt and evolve. Buy and hold is supposedly statistically and practically better for long-term prosperity. It takes advantage of time, compounding, market resilience and minimizes mistakes. A $10,000 investment in the S&P 500 held from 2000 to 2020 has grown to $32,000 despite two crashes, as opposed to timing attempts of $20,000 to $25,000 on average.

We are more optimistic than ever about the crypto market. Why? For one, regulatory clarity will boost legitimacy. By mandating 1:1 audited reserves for stablecoins as the backbone of the entire crypto system, fraud risks will be drastically reduced, creating trust and attracting institutional and government funds. If the law is passed by mid-2025, this alone could unlock hundreds of billions if not trillions in capital inflows. In addition, the EU’s MiCA (Markets in Crypto-Assets) rules, which have come fully into force in 2024, and similar guidelines in countries such as Dubai, Singapore, and Hong Kong are becoming more aligned with global realities, creating a more predictable environment. This reduces the stigma of the “Wild West” and promotes mainstream acceptance. In addition, technological advances such as layer 2 scaling, interoperability and AI integration usher in real world utility. Furthermore, “legacy‘ payment rails such as PayPal, Visa and Mastercard now support crypto transactions, with stablecoins such as USDT and USDC being processed at scale. Add to this the social and cultural dynamics developing with Generation Z and millennials favoring crypto over fiat systems according to recent surveys. Finally, the the dynamics developing around the tokenization of assets and we are in for an amazing ride. Hold tight.

In closing, here is Khalil Gibran: “The optimist sees the rose and not its thorns; the pessimist stares at the thorns, oblivious to the rose.” And no, we are not wearing rose-tinted glasses, we prefer to unemotionally concentrate on the fundamentals and they look very promising.

Thank you for your time and attention.

Sincerely,

Philipp L.P. von Gottberg